This time last year, new crop corn futures traded above $6.00 due to low supply caused by adverse weather and geopolitical issues, including the invasion of Ukraine. US farmers expected these trends to persist and held onto their crops, anticipating price increases. However, a record production year in the US and Brazil for 2023 led to a market oversupply, causing prices to drop significantly. As a result, farmers continued storing their corn, leading to a 16% increase in stored corn from the prior year.

Will corn continue lower for 2024?

In a recent article for Barchart, "Is Corn Ready for a Seasonal Pre-Summer Rally?" I mentioned the corn market's headwinds: "The carry-over from the previous crop year was excessive and may result in a smaller pre-summer price rally than usual. As producers see prices rallying to levels where they can hedge their new crop and retain a profit, we could see more aggressive commercial selling into rallies. Keep an eye on the COT report that is released each Friday." May 06, 2024

Source: Barchart

The downtrend is still intact, with no signs of a reversal. The media is full of bullish stories about corn prices, but the market defies them all as prices plummet.

Two significant crop reports—grain stocks and planted acres for the second quarter — will be released on June 28. Both have the potential to push prices significantly in either direction. Remember that the last trading day of the quarter could result in managed money traders not wanting to take new positions until the next trading session as they complete their trading for the quarter.

Will a price rally from the reports be a selling opportunity for the commercials?

Source: CMEGroup Exchange

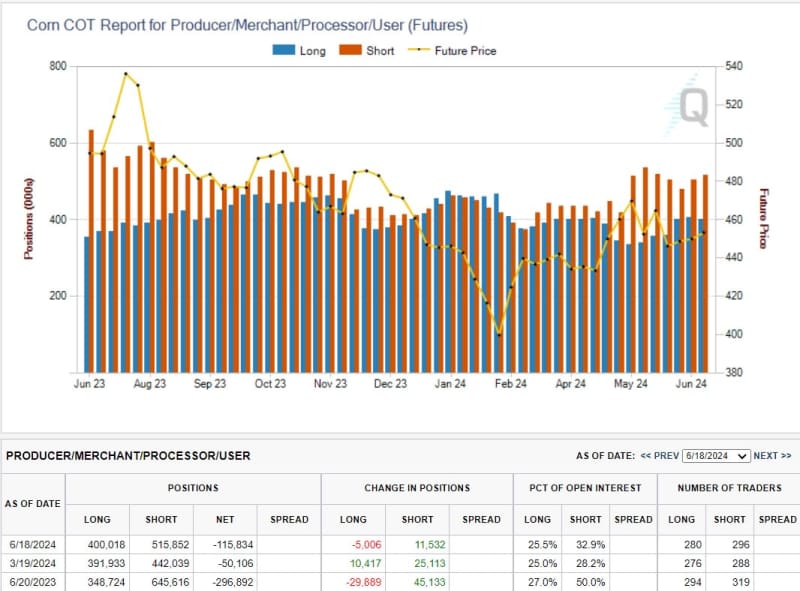

The recent disaggregated commitment of traders (COT) report shows the producers holding more shorts (red bars) than longs (blue bars). Another point to look at is that the price of corn (yellow line) is currently lower than it was one year ago. Considering the high levels of corn stored on farms today and the new crop being planted, hedging at a decent price is getting more difficult without a price rally.

Looking at the table below the graph, we can see that this time last year, producers held 646K short positions compared to this year, when they held only 516K. At this time last year, new crop corn was trading near $6.30; this year, it is near $4.50.

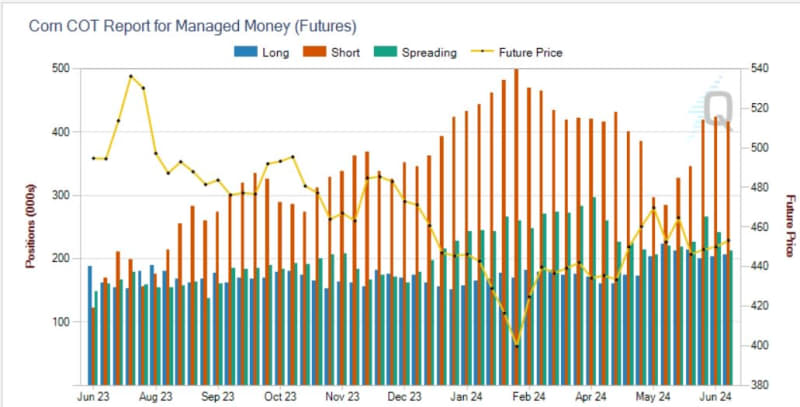

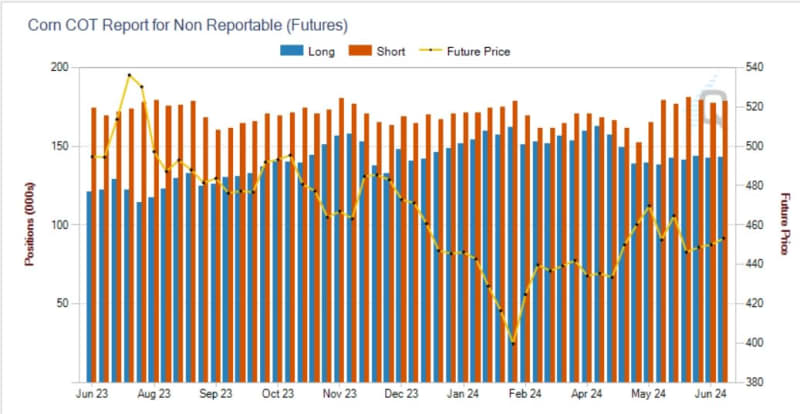

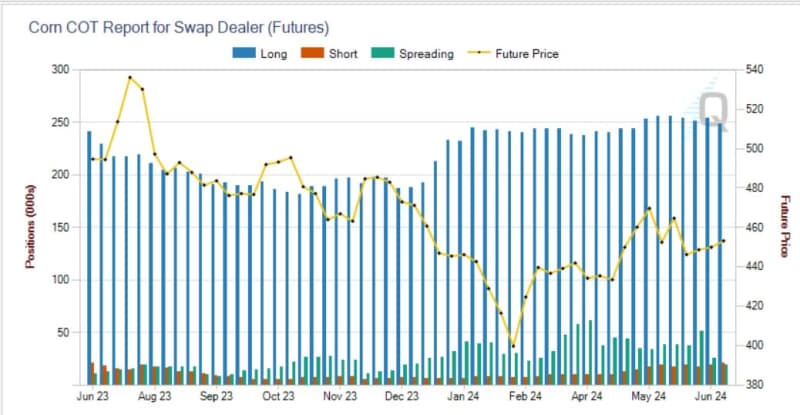

The corn market is getting crowded on the short side, as evidenced by the following few slides of COT reports for different traders of corn:

Source: CMEGroup Exchange

Source: CMEGroup Exchange

Source: CMEGroup Exchange

The producers, managed money, and non-reportable traders all hold net short positions (red bars higher than blue bars) in the corn market. The only group of traders holding net long positions is the swap dealers, hedging their positions.

A description of these types of traders:

- Producer/Merchant/Processor/User

A "producer/merchant/processor/user" is an entity that predominantly produces, processes, packs, or handles a physical commodity and uses the futures markets to manage or hedge risks associated with those activities.

- Swap Dealer

A "swap dealer" is an entity that deals primarily in swaps for a commodity and uses the futures markets to manage or hedge the risk associated with those swap transactions. The swap dealer's counterparties may be speculative traders, like hedge funds, or traditional commercial clients managing risk arising from their dealings in the physical commodity.

- Managed Money

For this report, a "money manager" is a registered commodity trading advisor (CTA), a registered commodity pool operator (CPO), or an unregistered fund identified by the CFTC. These traders manage and conduct organized futures trading on behalf of clients.

- Non-Reportable

Traders who hold positions under the reportable limits set by the exchange. Typically, retail traders are in this category.

Seasonal Pattern

In another article for Barchart, "Corn Prices – Sub $3.25 Before $6.00 Per Bushel?" I illustrated a seasonal selling pattern in the corn market. The seasonal window was relatively short, but it performed well.

It's important to note that while seasonal patterns can provide valuable insights, they should not be the sole basis for trading decisions. Traders must consider other technical and fundamental indicators, risk management strategies, and market conditions to make well-informed and balanced trading choices.

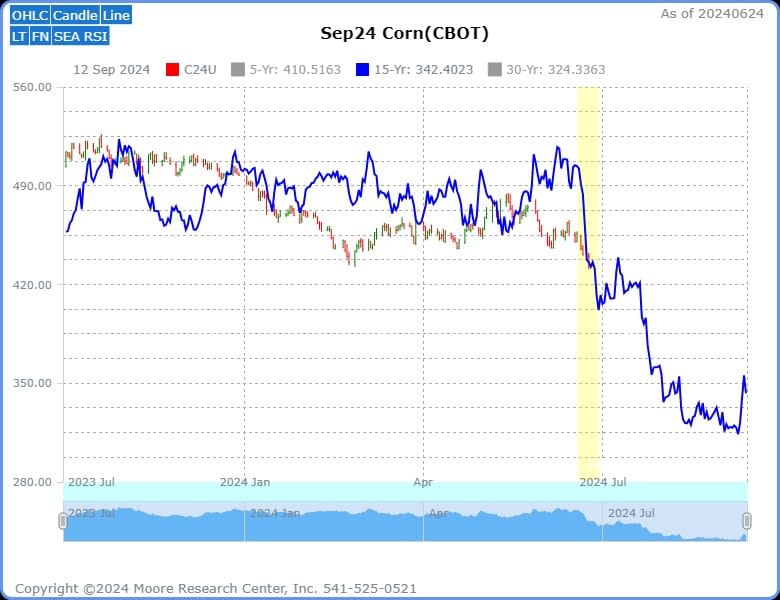

Source: Moore Research Center, Inc. (MRCI)

The 15-year average of corn prices (blue line) has a downtrend that usually begins around June and terminates during the Fall harvest season. The market appears to have a small rally at the end of this current seasonal window (right side of the yellow bar). This period coincides with the two upcoming reports on June 28. The report may give the corn market a relief rally, and the producers can sell futures to hedge their crops.

In the meantime, MRCI has a special corn report with another seasonal sale just after the current window expires.

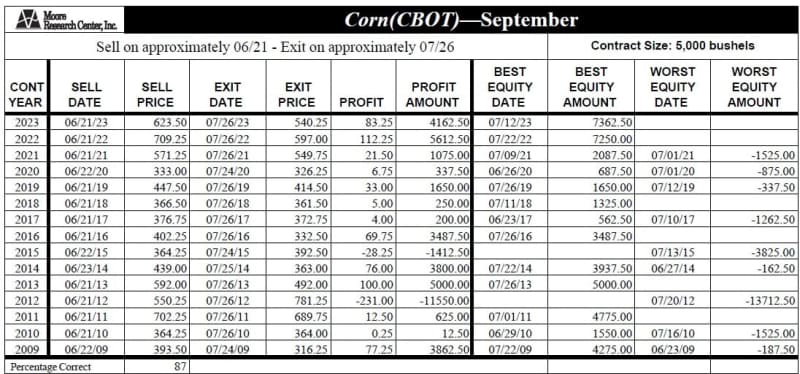

Source: MRCI

MRCI research has found that corn has closed lower on approximately July 26 than on about June 21 for 13 of the last 15 years, 87% of the time. Entering trades with no daily closing drawdowns is always a comfort to traders. This particular seasonal pattern had six years out of 15 with no daily closing drawdowns.

In closing…

The corn market has experienced significant fluctuations over the past year. Last year, new crop corn futures were trading above $6.00 due to low supply and geopolitical tensions. However, a record production year in 2023 led to an oversupply, causing prices to drop. Farmers continued storing their corn, leading to a 16% increase in stored corn from the previous year.

As we look ahead to the 2024 harvest season, market dynamics suggest that prices may remain low, but upcoming Grain Stocks and Planted Acreage reports could influence price movements. Traders should closely watch these reports and carefully consider their risk management strategies. Seasonal patterns and COT reports indicate that while the market faces headwinds, there may be opportunities for strategic selling during potential price rallies.

More Grain News from Barchart

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.