Athletic apparel company Lululemon Athletica Inc. (LULU) has hit rock bottom in the broader S&P 500 Index ($SPX) this year - or close to it, at least. While Walgreens (WBA) is officially the worst-performing SPX component of 2024 - particularly after today’s poorly received earnings report \- LULU is the worst performer among the S&P 500 that still has a consensus “Buy” rating from analysts, compared to a “Hold” for WBA. But should you actually buy LULU stock?

The slowdown in Lululemon's sales over recent quarters has ignited fears among investors that the company is losing its brand power amid rising competition. Amplifying these concerns was the departure of Chief Product Officer Sun Choe in May, a pivotal figure in Lululemon’s successful expansion into footwear.

However, despite these factors, Lululemon's latest quarterly results have sparked a resurgence in the stock, and leading fund managers are ramping up their holdings. With this in mind, could Lululemon's current downturn present a strategic entry point for investors? Let’s take a closer look to find out.

About Lululemon Stock

Founded in 1998, Canada-based Lululemon Athletica Inc. (LULU) is a leading innovator in technical athletic apparel, footwear, and accessories designed for yoga, running, training, and beyond. Renowned for its cutting-edge fabrics and functional designs, Lululemon collaborates with yogis and athletes globally to ensure continuous product enhancement through real-world feedback. The company’s market cap stands at $38.1 billion.

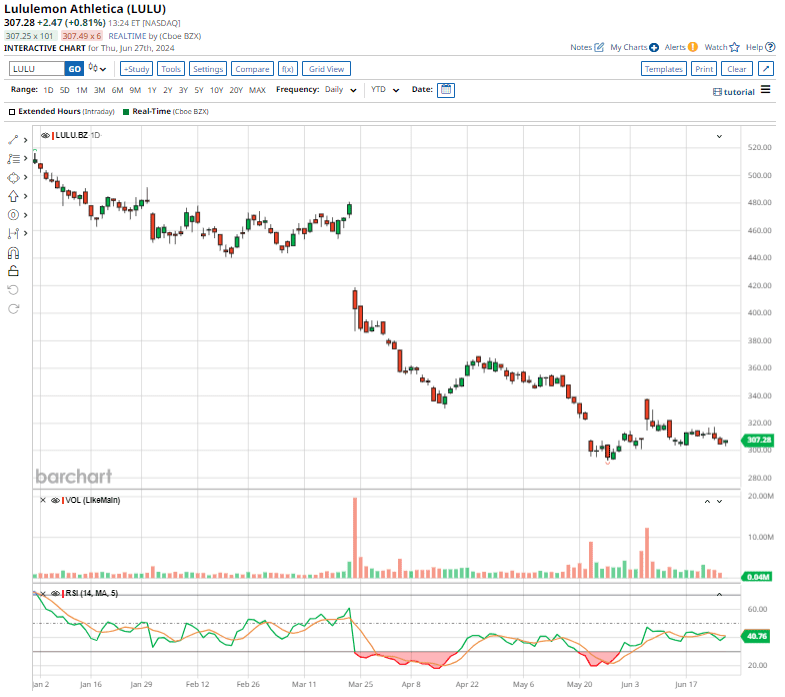

Despite its impressive history and strong brand presence, shares of this athletic apparel giant have significantly lagged behind the broader market. Over the past 52 weeks, the stock has plunged 18.2%, compared to the SPX’s gain of 25.1% during the same time frame.

Plus, in 2024 alone, LULU stock is down 400%, massively underperforming the SPX’s 14.8% return on a YTD basis.

Given the underperformance, the stock trades at 21.28 times forward earnings and 4.02 times sales, much lower than its own five-year averages of 45.53x and 7.63x, respectively.

Lululemon’s Q1 Earnings Beats Wall Street Projections

Amid mounting concerns over Lululemon’s slowing sales growth in a competitive athleisure market, the company’s better-than-expected Q1 earnings results announced on June 5 provided a much-needed boost, sparking a 4.8% jump in its shares in the subsequent trading session.

The company’s revenue of $2.2 billion jumped 10.4% year over year, narrowly edging past estimates. While Lululemon’s nearly flat annual growth in North American comparable sales remains a concern for investors, the robust 25% year-over-year rise in International comparable sales helped to balance these figures.

LULU’s Q1 EPS of $2.54 showed an annual improvement of 11.4%, and topped Street estimates by 6.7%. During the quarter, the company demonstrated confidence in future growth by repurchasing $296.9 million of its common stock.

As of April 28, Lululemon maintained strong financial flexibility to support its strategic objectives, with approximately $1.9 billion in cash and cash equivalents and $393.8 million available under its committed revolving credit facility. Plus, inventory levels at the end of Q1 stood at $1.3 billion, down from $1.6 billion recorded in Q1 of fiscal 2023.

Reflecting on the Q1 performance, CFO Meghan Frank said, “As we look to the rest of the year, we remain focused on leveraging our strengths and differentiated model to advance our Power of Three ×2 strategy and fuel performance. We are energized by the opportunities in front of us and believe we are well-positioned to drive sustainable, long-term growth."

For Q2, management anticipates net revenue to range between $2.40 billion and $2.42 billion, reflecting annual growth of 9% to 10%. Plus, EPS for the quarter is projected to arrive between $2.92 and $2.97.

Looking ahead to fiscal 2024, the company reaffirmed its guidance, projecting net revenues to land somewhere between $10.7 billion and $10.8 billion, while EPS is expected to be between $14.27 and $14.47.

Analysts tracking Lululemon expect the company’s profit to reach $14.29 per share in fiscal 2024, up 11.9% year over year, and rise another 10.2% to $15.74 per share in fiscal 2025.

What Do Analysts Expect For Lululemon Athletica Stock?

Following the company’s stellar Q1 earnings results, HSBC's Erwan Rambourg upgraded Lululemon from “Hold” to “Strong Buy” on June 6, setting a price target of $425. Rambourg highlighted Lululemon's "superior margin profile" and upcoming product launches, which he views as compelling for investors. The analyst believes LULU stock has been “overly punished" despite minimal changes to earnings estimates.

More recently, on June 26, Bank of America (BAC) analyst Lorraine Hutchinson reaffirmed a “Buy” rating on Lululemon with a price target of $440. Her bullish outlook hinges on Lululemon's latest impressive financial performance and effective inventory management.

Hutchinson emphasized that the recent reduction in inventory reserves, primarily related to Mirror inventory, has been misunderstood by investors. This adjustment does not impact the profit and loss, explained the analyst, but rather corrects the balance sheet. The market's misinterpretation of inventory reserve adjustments has potentially undervalued the stock, in BofA’s view, presenting an opportunity for investors.

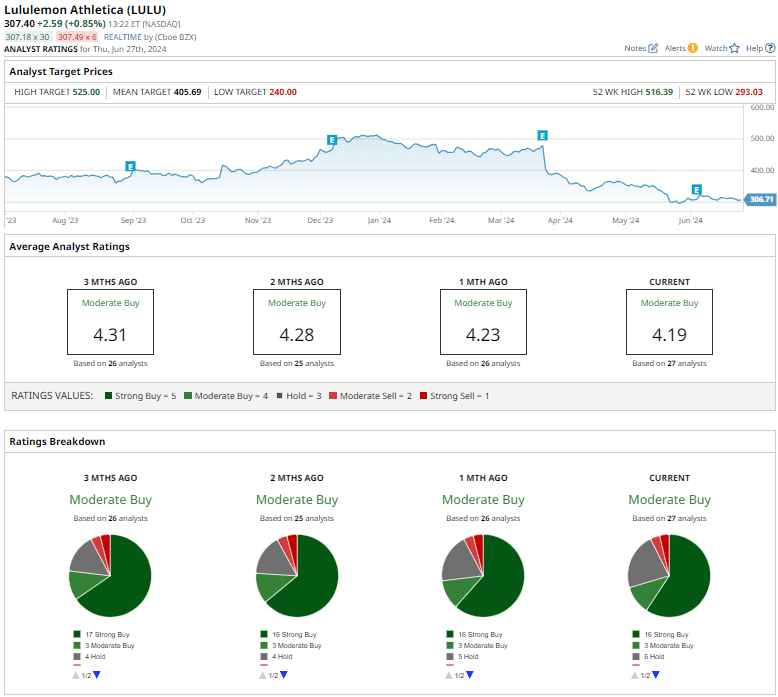

Overall, LULU stock has a consensus “Moderate Buy” rating. Out of the 27 analysts covering the stock, 16 suggest a “Strong Buy,” three recommend a “Moderate Buy,” six suggest a “Hold,” one advises “Moderate Sell,” and the remaining one gives a “Strong Sell” rating.

The average analyst price target of $405.69 indicates a potential upside of about 32% from the current price levels. The Street-high price target of $525 suggests that LULU stock could rally as much as 70.7%.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.