In the first half of 2024, the real estate investment trust (REIT) group underperformed, as markets repeatedly pushed back their expectations for Fed interest rate cuts. As we head into the third quarter, real estate is the only negative sector on a YTD basis, which pretty effectively highlights the challenges this group has faced so far.

With markets now expecting maybe one rate cut this year, at best, data from S&P Global (SPGI) indicates that U.S. REITs wrapped up the month of May at an average 16.5% discount to net asset value (NAV) - extending a string of double-digit NAV discounts, but off the prior month's lows. That's notable for income-focused investors, since REITs must distribute at least 90% of their taxable income as dividends. So, the cheaper you can buy the shares, the higher your effective yield.

For investors willing to wade into the real estate waters, here's a closer look at three “Strong Buy” REITs that offer attractive yields and solid growth potential at current levels.

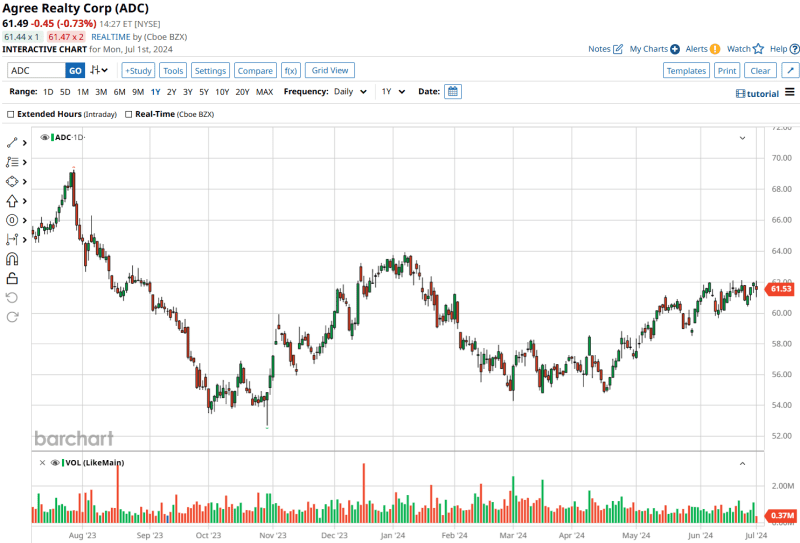

#1. Agree Realty: Reliable Dividends and Steady Growth

Agree Realty Corporation (ADC) is a retail-focused REIT that owns, acquires, develops, and manages properties leased to top retailers. Founded in 1971, ADC has built a strong portfolio of over 2,161 properties across 49 states, totaling about 44.9 million square feet of leasable space. Known for its monthly dividend payments, ADC offers a regular dividend of $0.25 per share, which translates to an annual payout of $3.00 per share and a forward dividend yield of around 4.84%.

ADC stock is down about 2% on a YTD basis, and the stock has lost more than 10% since setting a 52-week high of $69.26 last July.

With a market cap of $6.23 billion and enterprise value of $8.8 billion, ADC recently announced a $450 million public offering of 5.625% senior unsecured notes due 2034, which should give the company more runway for funding and investment opportunities.

In Q1 2024, ADC reported FFO of $1.03 per share on $149.5 million in revenue, which surpassed consensus expectations. ADC's price/adjusted funds from operations (AFFO) ratio stands at 15.03, which is right in line with the sector median.

Looking ahead, AFFO per share for 2024 is expected to reach $4.12, up more than 4%.

Analysts maintain a “Strong Buy” consensus on ADC, with the average price target of $66.20 representing about 7.3% upside potential. Out of 17 analysts, 11 recommend a “Strong Buy,” 2 suggest a “Moderate Buy,” and 4 say it's a “Hold.”

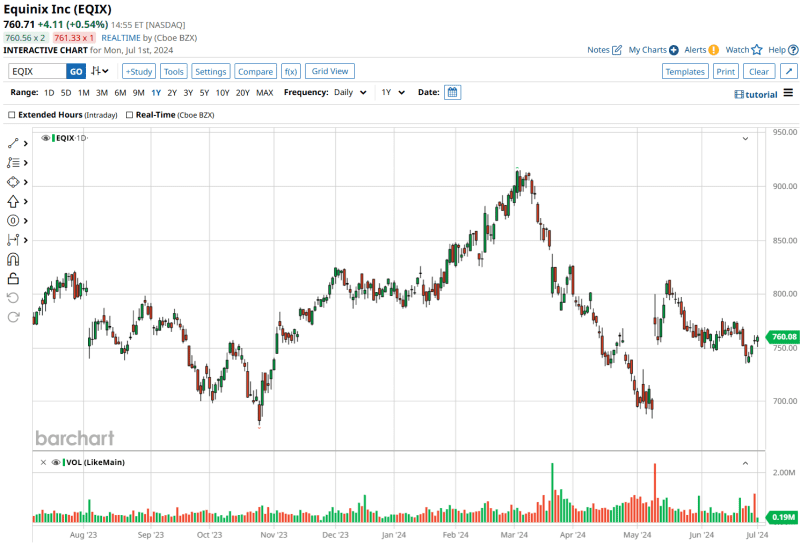

#2. Equinix: Digital Infrastructure Growth Potential

Equinix Inc. (EQIX) is a global leader in digital infrastructure, specializing in internet connections and data centers. Headquartered in Redwood City, California, Equinix operates over 260 data centers across 33 countries, providing essential infrastructure for businesses to connect and grow in the digital age. Since converting to a REIT in 2015, Equinix has been a reliable dividend payer, currently offering a quarterly dividend of $4.26 per share. That translates to an annual payout of $17.04 and a forward yield of approximately 2.25%.

EQIX is down about 17% from its March highs, with a sharp sell-off that month triggered by a short seller report.

Equinix bounced back after its Q1 2024 earnings report on May 8, despite mixed results. The company reported revenue of $2.13 billion, up 6% year-over-year, but slightly below estimates of $2.14 billion. Q1 AFFO improved to $8.86 per share, surpassing expectations for $8.64.

Looking ahead, analysts project full fiscal year 2024 revenue of $8.77 billion, with AFFO of $24.41 per share.

Recently, Equinix partnered with Dell Technologies (DELL), another data center heavyweight, to offer Dell PowerStore on Equinix Metal, a new enterprise-grade Storage as a Service (STaaS) solution. This will enhance Equinix's cloud-adjacent storage portfolio, providing enterprises with low-latency connectivity and proximity to major public clouds. Separately, Equinix priced a $750 million public offering of 5.500% Senior Notes due 2034, with proceeds earmarked for acquisitions, development opportunities, and general corporate purposes.

With a market cap of approximately $71.8 billion, Equinix is priced at 21.6x forward AFFO - richer than the sector median, but in line with the more ambitious growth targets for data center REITs.

Analysts remain optimistic about Equinix's prospects. Out of 24 in coverage, 17 analysts rate EQIX stock a “Strong Buy,” 1 recommends a “Moderate “Buy, and 6 are saying it's a ”Hold." The mean target price is $903.41, suggesting a potential upside of approximately 18.9%.

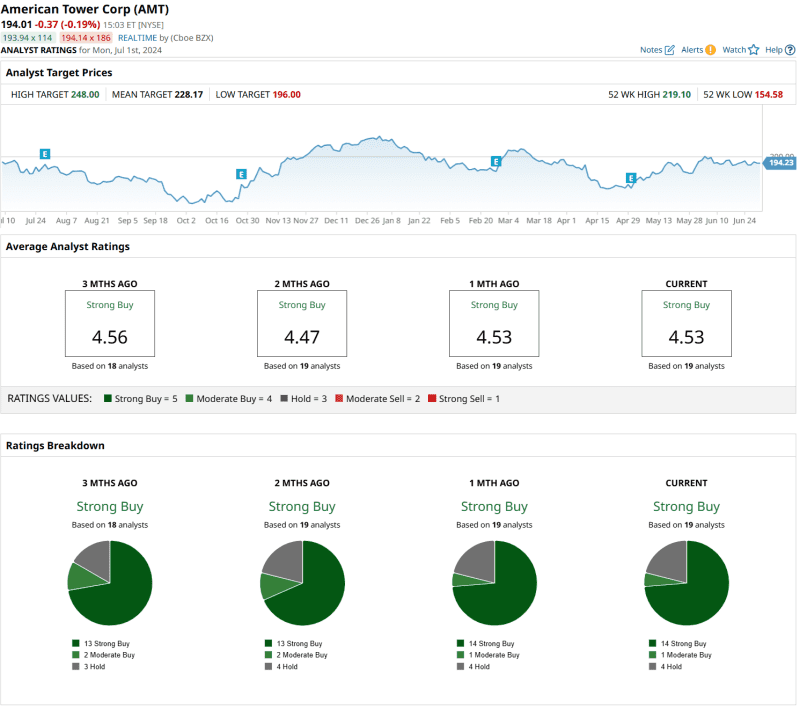

#3. American Tower: Strong Dividends and Strategic Expansion

American Tower Corporation (AMT), is a major player in wireless and broadcast communications infrastructure. Based in Boston, AMT manages over 224,000 communication sites globally, supporting modern telecommunications. Since becoming a REIT in 2012, AMT has consistently increased its dividends for 11 consecutive years, and currently offers a quarterly dividend of $1.62 per share. That result in an annualized payout of $6.48 per share for a forward yield of 3.37%.

AMT stock is nearly unchanged over the past 52 weeks, and has pulled back about 10% so far this year.

With a market cap of approximately $90.7 billion, AMT is priced at 18.6x forward AFFO, slightly above the sector median - indicating investors are pricing in premium growth prospects related to the company's footprint in the expanding 5G and data center markets.

American Tower has been proactive in managing its debt and funding growth by issuing $1.3 billion in senior unsecured notes to repay existing debt under its $6.0 billion senior unsecured multicurrency revolving credit facility.

AMT's Q1 2024 earnings report, released on April 30, showed a solid performance. Total revenue increased by 2.4% year-over-year to $2.834 billion, with property revenue up by 3.3%. FFO checked in at $2.79 per share, beating the $2.55 consensus forecast.

For the full fiscal year 2024, AMT's FFO is estimated at $10.03 per share, with revenue expected to reach $11.23 billion. The next earnings release is scheduled for July 30.

Analyst sentiment towards AMT remains overwhelmingly positive, with the mean target price of $228.17 suggesting a potential upside of about 17.6% from the current price. Out of 19 analysts, 14 rate it a “Strong Buy,” 1 says it's a “Moderate Buy,” and 4 recommend a “Hold.”

The Bottom Line on the Best REITs to Buy

So, if you're looking for solid REITs to boost your passive income, ADC, EQIX, and AMT are definitely worth considering. They each present unique and compelling investment opportunities within the REIT sector. While not all of these names trade at the discount you might expect, the steady dividend payouts, stronger-than-usual data center growth potential, and lower-than-ever rate cut expectations should bode well for this group going forward.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.