A summary of the past 13 months since I start to Invest

I have talked too much about cash flow. I just mentioned cash flow by dividends: I reach $1000 Dividend Milestones, which is nice, but it is only a small part. I also discussed credit cards before: Credit Card: A Big Cash Flow Generator. Today I want to show you how much I earned from credit cards.

I mainly swipe American Express cards as the points I earn can be transferred to a brokerage account for cash investment. There are 3 ways to earn points:

- Welcome Bonus(The most generous way to capture points)

- Using cards every day(a persistent way to earn)

- Refer Friends(Each person will have a 55000 points limit per year to earn refer bonus, it is easy to achieve between couples)

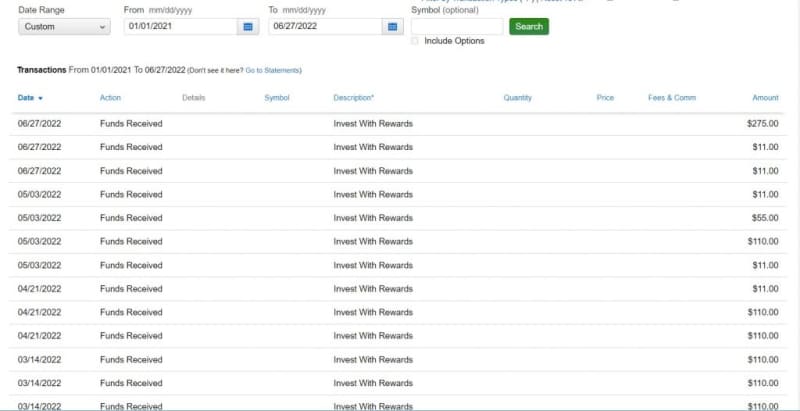

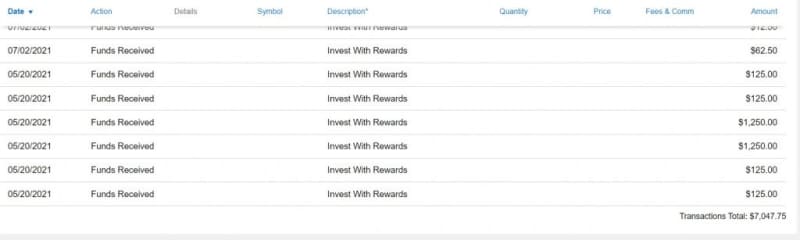

Because I transferred all the points into the Schwab brokerage account at the ratio of 1 point=1.1 cent, let me show you all the rewards I received in my Schwab account:

Date Range: 1/1/2021 to 6/27/2022, you can see I have the points transfer almost every month(Described as Invest with Rewards):

In the past 18 months, the total investment from AMEX points is $7047.75, which equals $391.5 per month! However, I actually started invest from last May, so the real average would be 7047.75/13, which equals $542 per month!

How do you think the $542 cash flow per month(It even doesn’t include my wife’s account )? That’s why I love to use credit cards for all my spending to build a cash flow!