No Matter whether you are a US college student or an international student, once you start your college life, you will face a completely different life. You will be more independent, and most importantly, you need to control your own financial situation, including your credit score. Because after you finish college, there are many situations that require you have excellent scores, such as auto loans, mortgages, and even employment. So, I think it is better to build credit score from the first day in your college.

To understand credit score, first, let’s explain more about it. A credit score is a rating system that evaluates:

- 1. How much you can borrow

- 2. How possible that you can pay off the debt without a problem.

As a student, you don’t have enough income which can boost your credit limit, so it is not your priority to focus on”how much you can borrow”. However, the second part, how possible you can pay off, it is calculated, based on your history. In another word, the lender will check your payment history to see if you can pay your debt successfully in the past. The keyword is HISTORY. The early you can have such a history, the more likely you will have a good score.

As a student, the easiest way to build a credit history is to have a credit card. You spend and pay the balance on time, it will undoubtedly boost your credit score. However, at this moment, you may not have any credit history, how could the bank approve a credit card for you? It sounds like a dilemma.

To solve this problem, a secured credit card is your solution. “Secured”, means the bank doesn’t know your ability to borrow and pay but is willing to test your ability if you can deposit money into the account first. For example, you can deposit $1000 to a bank, then you get a credit card with a $1000 limit. Then after 1 year, you spend and pay the balance on time, which will be reflected in your credit history. This history will boost your credit score!

There are several choices of secured credit cards, many of them have either an annual fee or other hidden fees such as late fees, and high APR if you forgot the payment just 1 day later.

Chime, a popular Fintech company, offers a combination of a saving account and a secured credit card, which I think is more convenient for students as you only need to have one account to manage. Or, you can understand that you are using a saving account to build a credit score, sounds unbelievable, right?

First, you need to click the Link to open a saving account. (It is insured by FDIC so there is no risk). This account has no fee at all.

- no late fees

- no minimum balance

- no monthly service fees

- no foreign transaction fees

- no transfer fees

- Fee-free Up to $200 overdraft

- Get Direct Deposit paid 2 days earlier.

Second, set up the Direct Deposit, to enroll the credit builder function, which is the Secured credit card for you. The enrollment doesn’t need a credit check(Another sweet point because many students will fail in the credit check for sure as you have low or no credit scores. Then you need to go to talk with the banker, which is time-consuming, and may still not be able to secure a card ). And the Credit builder doesn’t have an annual fee or interest rate.

Third, start to move the money you want to spend from your checking to the credit builder, this amount of money will be your credit limit and the fund to pay off your spending.

Fourth, start to use the credit card to spend, and pay off the balance using the fund we mentioned in the previous step.

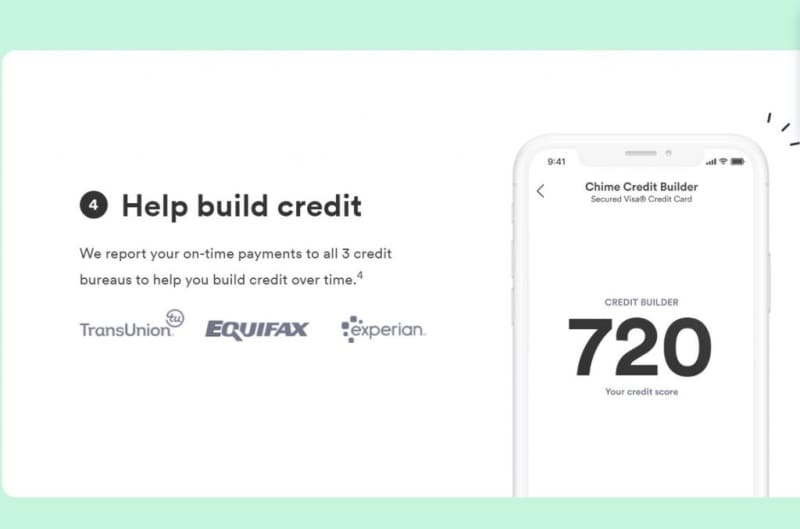

Chime will report your credit history to 3 major credit bureaus.

I also talked similar topic here: Credit Card Noob Class: How to Build Credit.