By Jack Barnett

London’s FTSE 100 today initially batted away fears of a tough recession in the UK, before giving up gains later in the day.

The capital’s premier index fell 0.88 per cent to 7,361.63 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, shed 0.1 per cent to dip to 19,149.65 points.

During early exchanges, both indexes bumped into positive territory.

Soaring inflation driven by unprecedented rises in wholesale gas prices is likely to tip Britain into a prolonged slump.

Energy regulator Ofgem last week said bills will rise 80 per cent in October, squeezing household incomes and possibly sending inflation near 20 per cent, some economists have warned.

“Companies and households are waiting for some radical solutions, before a winter of woe sets in with warnings coming thick and fast that businesses, particularly in the bar and pub industry will go to the wall without significant support,” Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said.

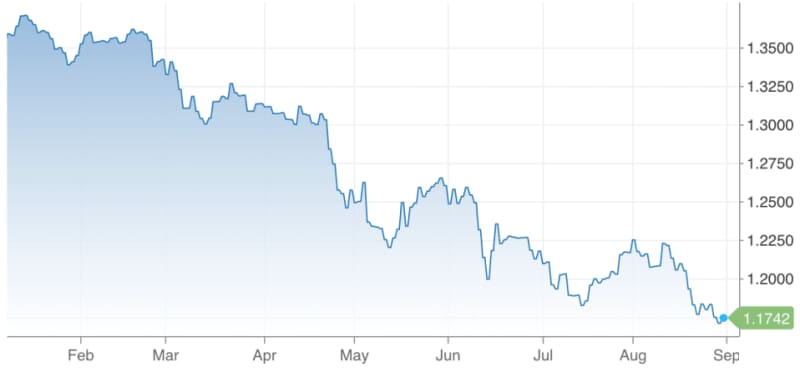

Fears of a tough recession put strong downward pressure on the pound, which briefly tumbled to the lowest level against the US dollar since the first Covid-19 lockdown in March 2020.

Yields on UK government debt pushed higher, caused by investors ditching sterling-denominated assets and pouring in dollar-based assets to capitalise on the Federal Reserve’s rapid rate hike cycle.

London FTSE 100-listed industrial stocks led the index lower, with miners Antofagasta and Fresnillo losing more than five per cent apiece, dragged down by tumbling commodity prices.

Oil prices collapsed nearly seven per cent.

GBP/USD exchange rate

The post London’s FTSE 100 gives up early gains as investors fret over looming downturn appeared first on CityAM.