By Jack Barnett

Investors will be parsing over a slew of results from top retailers for signs of a slowdown in consumer spending in response to an economic slump.

London’s premier FTSE 100 index notched a poor performance last week, shedding 3.62 per cent to close at 7,018.60 points, mainly driven by a sharp sell off on Friday after chancellor Kwasi Kwarteng’s huge ‘mini-budget’.

The domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, also posted an awful week, losing nearly five per cent to finish below the 18,000 point mark.

A mix of retailers update markets this week from different parts of the sector.

High-street fashion chain Next posts what are expected to be a tame set of half year results on Thursday driven by the unusually warm start to autumn causing consumers to retain their existing wardrobes.

“Sales momentum is likely to have picked up over the past week or so, but our expectations of a slow start means that material changes to forward guidance look unlikely,” analysts at broker Peel Hunt said.

Online fashion store and FTSE 250-listed Boohoo updates markets on Wednesday.

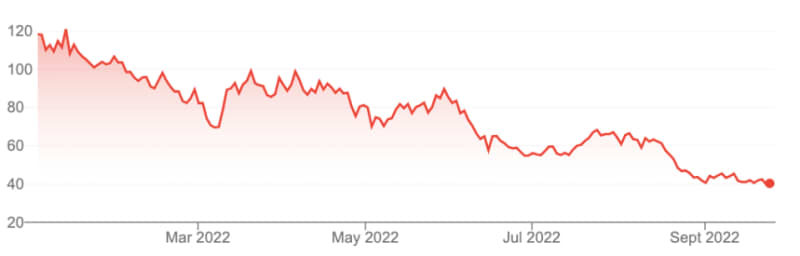

Boohoo’s share price this year

The firm’s share price has tanked around 66 per cent this year, driven by concerns over worker welfare and the introduction of a new £1.99 returns policy prompting consumers to look elsewhere.

Budget retailer Aldi also posts financials this week.

Analysts are expecting the German supermarket to have benefited from Brits trading down to cheaper alternatives in response to the cost of the living crisis.

On the economic front, new GDP figures out on Friday covering the three months to June may show the UK economy is performing much worse than first estimated.

Credit card spending figures on the same day could reveal households are turning to risky debt due to soaring prices squeezing their finances.

The post Investors to examine retailers’ books for signs of spending slump appeared first on CityAM.