By Jack Barnett

London’s FTSE 100 squeezed out a small gain today despite investors ditching house builders in response to the Bank of England signalling it will hike interest rates sharply.

The capital’s premier index edged 0.03 per cent higher to below the 7,020.95 points, while the domestically-focused mid-cap FTSE 250, which is more aligned with the health of the UK economy, shed 1.39 per cent to reach 17,722.83 points.

Bank governor Andrew Bailey was forced to issue a statement today to reassure markets after the pound plummeted to a record low against the US dollar.

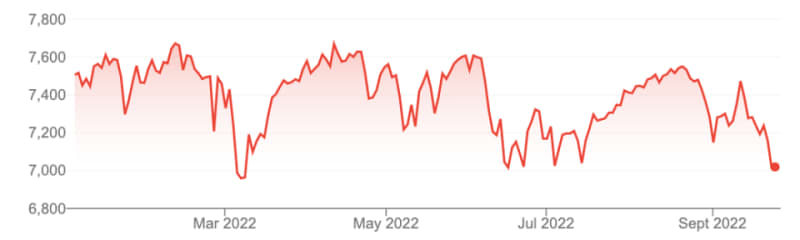

FTSE 100 year to date

He said the monetary policy committee “will not hesitate” to hike interest rapidly to get inflation, running at 9.9 per cent, back to the Bank’s two per cent target.

Investors had been speculating throughout the day that the Bank may launch an emergency rate hike to support the pound.

In early evening trading, sterling was down 1.6 per cent against the dollar and 0.69 per cent against the euro.

A combination of prime minister Liz Truss stepping up borrowing and steep rate hikes in the US has forced the pound lower.

A weak pound often lifts the FTSE 100 by making the UK’s exports more competitive.

However, the prospect of higher borrowing costs hit house builders.

London’s FTSE 100 was dragged down by Taylor Whimpey shedding more than seven per cent.

Persimmon sank 6.63 per cent, while Barratt and Berkely lost more than 4.8 per cent.

Taylor Whimpey and Berkeley Group also lost more than four per cent.

Another Bank rate hike would raise mortgage costs, possibly cooling demand in the housing market.

Britain’s largest banks were also a drag on the FTSE 100.

Consumer-focused stocks were also lower today, driven by investors fretting over a UK economic slump hitting spending.

Oil prices slumped over two per cent.

The post London’s FTSE 100 squeezes out gain as house builders tumble appeared first on CityAM.