By Jack Barnett

London’s FTSE 100 was dragged down today by investors ditching shares in the UK’s largest banks despite a strong set of results, but managed to squeeze gains thanks to a late rally.

The capital’s premier index jumped 0.61 per cent to over the 7,000 mark points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, climbed 1.54 per cent to 18,105.89 points.

Britain’s high street banks curbed the FTSE 100’s gains despite several of the sector’s largest players posting better than expected results this week.

This morning, Barclays announced profits climbed six per cent over the last year, driven higher by a series of Bank of England rate hikes allowing the firm to charge more for loans.

Similarly, HSBC, the UK’s largest bank, earlier this week posted a shallower than expected profit fall, boosted by net interest income rising substantially.

Asia-focused lender Standard Chartered also today said profits rose 40 per cent over the last year.

Despite the results topping analyst expectations, Standard Chartered slumped to the bottom of the FTSE 100, shedding 5.12 per cent.

Barclays fell 0.27 per cent.

Barclays’s “underlying income performance was comfortably ahead of expectations. There appears to be no material change to prior financial guidance,” analysts at Shore Capital said.

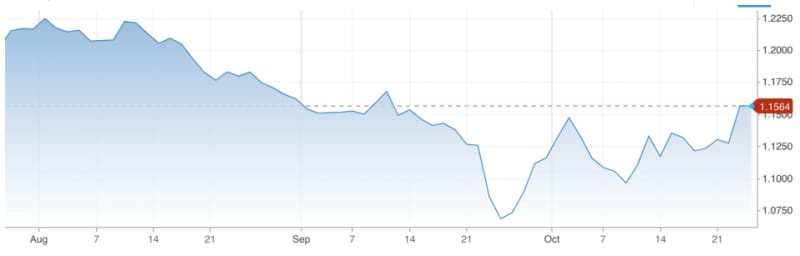

The pound strengthened sharply against the US dollar, up nearly one per cent on Rishi Sunak’s second day as prime minister.

Pound/US dollar exchange rate

His pledge to put the public finances on a more sustainable path has calmed markets.

The yield on the 10 year gilt, the government borrowing benchmark, fell seven basis points. Yields and prices move inversely.

Analysts said they investors have been flocking to gilts in the weeks after Liz Truss’s disastrous mini-budget on 23 September to capitalise on higher returns.

“Gilts can be useful as a diversifier for a share portfolio, because their prices often move in the opposite direction to equities. Until recently, prices had been so high, and yields so low, that these bonds had been described as offering ‘return-free risk’, and with good reason as this year’s sell-off has highlighted,” Laith Khalaf, head of investment analysis, AJ Bell.

Oil prices fell over one per cent.

The post FTSE 100 weighed down by banks and pound strengthens on Sunak’s second day in No 10 appeared first on CityAM.