By Stephan Roth

Mazars has ceased work on providing proof-of-reserves statements with Binance, Crypto.com and other crypto firms, amid industry-wide uncertainty following the collapse of FTX and Alameda Research.

The French auditor was hired by Binance earlier this month to undertake a proof-of-reserves assessment of the exchange – an attempt to identify if the exchange held enough assets to match its customer deposits.

“Mazars has indicated that they will temporarily pause their work with all of their crypto clients globally, which include Crypto.com, KuCoin and Binance. Unfortunately, this means that we will not be able to work with Mazars for the moment”, a spokesperson from Binance told CoinDesk.

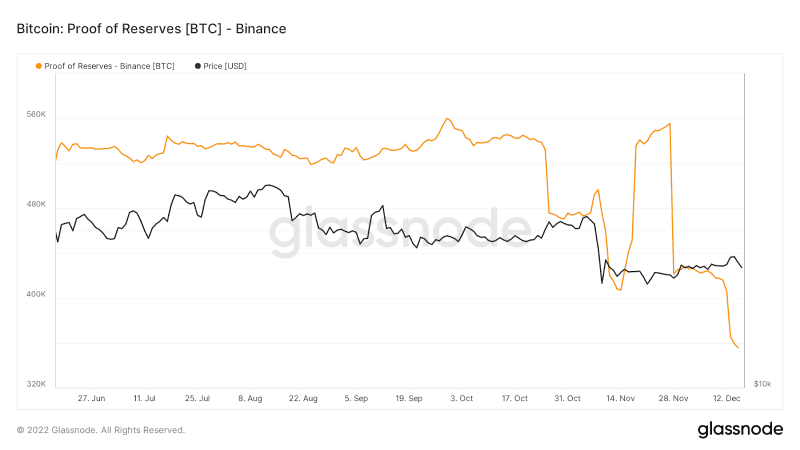

The auditor found that Binance’s reserves were overcollateralized at 101 per cent, with fellow clients and crypto exchange KuKoin’s reserves also holding excess collateral.

Only Crypto.com heldan exact 100 per cent or a 1:1 reserve backing, following their own proof-of-reserves assessment with Mazars last week.

In a statement, Kris Marszalek, CEO of Crypto.com said: “Providing audited Proof of Reserves is an important step for the entire industry to increase transparency and begin the process of restoring trust”.

Following theFTX’s bankruptcy and former CEO Sam Bankman-Frieds now in custody in the Bahamas, consumers and regulators have become even wearier of the turbulent crypto industry.

Earlier this week, more than £820m were removed from Binance following as investors feared that the exchange could be subject to investigations in the US.

In a Twitter post, Binance CEO responded to the withdrawals by saying: “We have seen this before. Some days we have net withdrawals, some days we have net deposits. Business as usual for us.”

The post Auditor Mazars halts work with Binance appeared first on CityAM.