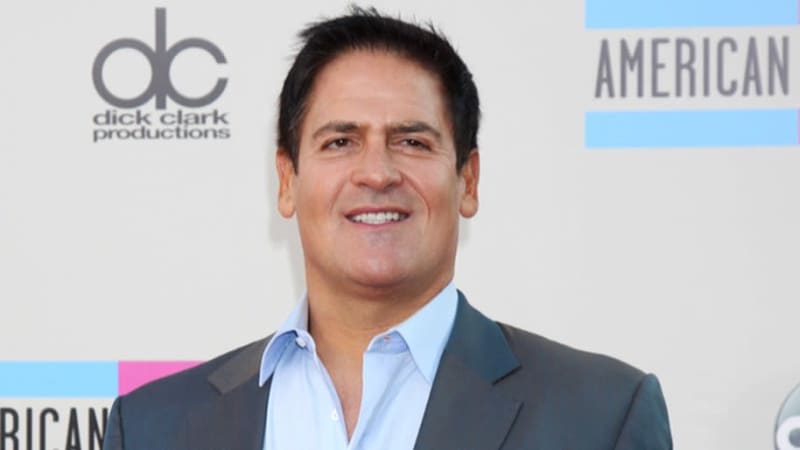

Mark Cuban, the billionaire investor and television personality, criticized the U.S. Securities and Exchange Commission for its inaction following the Mt. Gox debacle. Cuban also lauded Japan’s regulatory response to the incident.

What Happened: Cuban took to social media platform X, to express his views on the SEC’s handling of the Mt. Gox situation. He contrasted this with Japan’s approach, which he commended for protecting its stakeholders.

“The SEC didn't learn sh*t. Not a damn thing when MT Gox happened. They are still so stupid they think the mere process of registration protects investors. The only actions they take are after the fact. See Madoff. See FTX. See Chinese Stocks,” Cuban wrote.

He also criticized the SEC’s approach to innovation, stating that it is “completely the opposite of our technology history in the USA.” He further questioned the SEC’s ability to protect investors from scams, suggesting that the regulatory body is “really really bad” at it.

Cuban responded to a post by Mike Kelly, which questioned the potential of 65 tokens in Japan to be breakthrough applications. Cuban pointed out that even the “scammiest of the scammiest tokens” haven’t caused as much loss as other investments.

Why It Matters: Cuban’s criticism of the SEC’s regulatory approach comes amid a broader debate on the regulation of cryptocurrencies. In a recent exchange with James Love, Director of an NGO Knowledge Ecology International, Cuban highlighted the various benefits of digital assets, including minimal transaction fees, easily accessible credit, and insulation against theft.

Meanwhile, the Mt. Gox incident has been a long-standing issue in the cryptocurrency space. The exchange, once the world’s leading Bitcoin (CRYPTO: BTC) exchange, suffered a devastating hack in 2011 and subsequently filed for bankruptcy in 2014. However, there is now a glimmer of hope for creditors, with some reportedly receiving updates on their claims.

At the same time, the SEC’s regulatory approach has been a source of frustration for many in the crypto space. Robinhood CEO Vlad Tenev recently expressed his disappointment with the SEC’s response to the company’s efforts to engage with the regulatory body.

Image Via Shutterstock

Engineered by Benzinga Neuro, Edited by Kaustubh Bagalkote

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you. Learn more.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.