Artificial intelligence (AI) is revolutionizing biotechnology, offering unprecedented computational power to solve complex biological puzzles. In the fusion of AI and biotech, Moderna, Inc. (MRNA) and its OpenAI partnership stand out as a true catalyst for innovation. By integrating ChatGPT Enterprise across Moderna’s operations, the company is set to supercharge drug development, building on its successful mChat initiative.

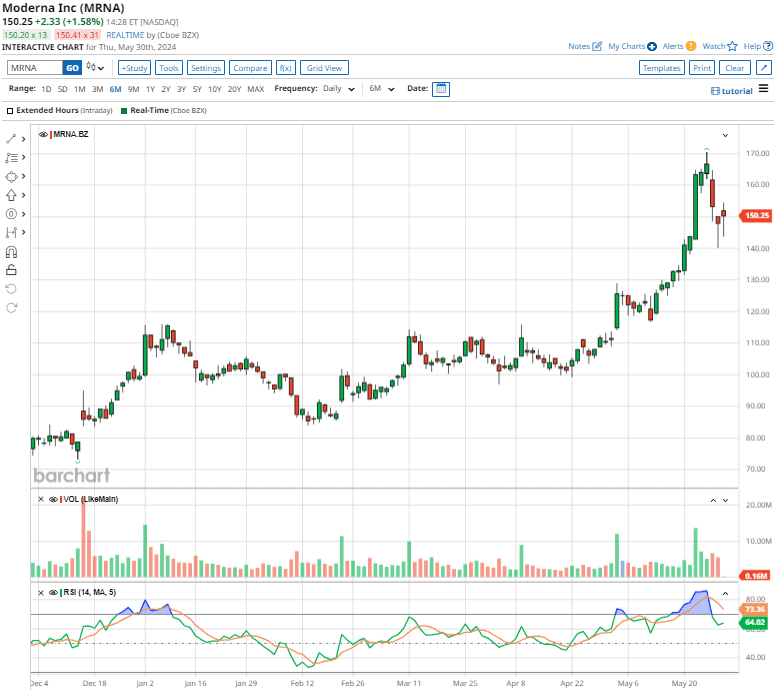

Biotech stocks can be volatile, but they also offer the promise of groundbreaking innovations, making them attractive to investors looking for strong growth opportunities. MRNA stock, for instance, has impressively rallied 51.4% on a YTD basis, outpacing the broader market. Its recently released positive phase 1 cancer vaccine trials and Q1 earnings beat have added to the stock’s momentum.

With the OpenAI partnership in play, could Moderna leverage the collaboration to elevate itself to new heights in biotech innovation? Let's take a closer look.

About Moderna Stock

Headquartered in Cambridge, Moderna, Inc. (MRNA) is a biotechnology company that revolutionizes medicine with cutting-edge messenger RNA technology. Famous for its Spikevax COVID-19 vaccine development, Moderna is now pushing boundaries with innovative vaccines and therapies targeting infectious diseases, cancer, and rare conditions.

Since going public in 2018, the company's mRNA breakthroughs quickly dominated its revenue. With a market cap of $56.7 billion, Moderna's relentless scientific commitment positions it as a biotech trailblazer.

Shares of the biotech powerhouse have rallied 19.3% over the past 52 weeks, lagging the S&P 500 Index’s ($SPX) 25% returns, but outperforming the S&P Biotech SPDR’s (XBI) single-digit gain.

However, over the past six months, MRNA stock is up a whopping 90.5%, outshining both the SPX and XBI over the same time frame.

In terms of valuation, the stock is trading at 9.32 times sales, which is lower than its own five-year average multiple of 63.91x.

Moderna’s Q1 Earnings Beat Wall Street Projections

On May 2, the biotech pioneer reported Q1 earnings results that beat on both the top and bottom lines, which led to a 12.7% surge in the stock. Moderna's Q1 revenue hit $167 million, beating projections by 33.2%, despite being a fraction of last year's $1.9 billion due to waning COVID-19 vaccine demand.

The company posted a net loss of nearly $1.2 billion, or $3.07 per share, compared to last year's profit of $79 million, or $0.19 per share. However, the loss was narrower than consensus estimates, impressing investors who expected worse.

Looking ahead, the company forecasts $4 billion in sales from its respiratory vaccines, with about $300 million expected in the first half of 2024. Year-end cash and investments are projected to be approximately $9 billion.

Analysts tracking Moderna predict its loss per share to narrow by 39.4% to $7.47 in fiscal 2024 and then improve by another 28.9% to $5.31 in fiscal 2025.

What's Driving Growth at Moderna?

In April, Moderna rallied on promising cancer-vaccine data unveiled at the American Association for Cancer Research meeting. The data showcased efficacy beyond melanoma, highlighting improved survival rates in HPV-negative head-and-neck cancer. Jefferies analysts praised these results, and anticipated FDA discussions for accelerated approval in adjuvant melanoma by year-end.

Meanwhile, Moderna continues to lead in mRNA technology, advancing its respiratory syncytial virus (RSV) vaccine through a phase 2/3 trial. Leveraging AI, the company automates mRNA production, streamlining research processes. Collaborating with International Business Machines Corporation (IBM) last year on AI and quantum computing further underscores its commitment to innovation.

Integrating OpenAI's ChatGPT Enterprise across departments has empowered Moderna with over 750 large language models, enhancing tasks like legal and payment processes. This AI integration aids critical decisions, notably optimizing vaccine doses crucial for clinical trial success. Already, this initiative has reduced Q1 expenses by 10%, exemplifying AI's transformative impact on Moderna's operational efficiency and development strategies.

Moreover, whenever there's a viral outbreak, Moderna is right there in the thick of it. Moderna swiftly jumped into action upon the human emergence of the avian flu (H5N1 virus), confirming ongoing vaccine testing. The U.S. government is nearing a deal to fund a late-stage trial for Moderna's mRNA pandemic bird flu vaccine, highlighting the company's proactive response to the virus.

What Do Analysts Expect for Moderna Stock?

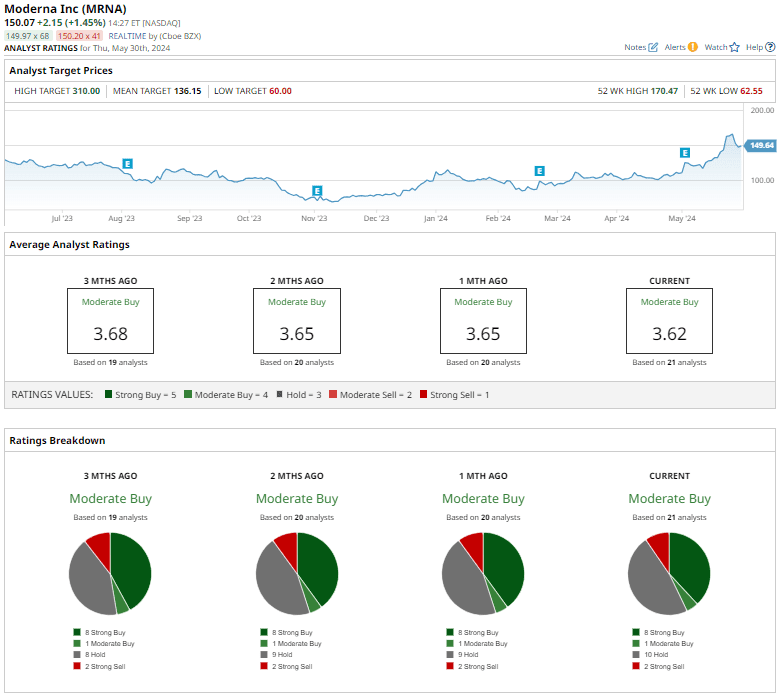

On May 7, UBS (UBS) analyst Eliana Merle maintained a “Buy” rating on MRNA stock and raised the price target from $143 to $151. Merle's report underscored Moderna's potential, noting, "UBS sees continued upside for the stock and a potential inflection on the horizon with cytomegalovirus Phase 3 data potentially later this year and individualized neoantigen therapy Phase 3 trials underway."

Moderna has a consensus “Moderate Buy” rating overall. Out of the 21 analysts offering recommendations for the stock, eight recommend a “Strong Buy,” one advises a “Moderate Buy,” 10 suggest a “Hold,” and the remaining two give a “Strong Sell” rating.

Despite trading at a premium to the mean price target of $136.15, the Street-high target price of $310 for Moderna implies the stock could rally as much as 107.5%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.