Financial giants have made a conspicuous bullish move on CVS Health. Our analysis of options history for CVS Health (NYSE:CVS) revealed 20 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $292,695, and 13 were calls, valued at $794,986.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $47.5 to $65.0 for CVS Health during the past quarter.

Volume & Open Interest Trends

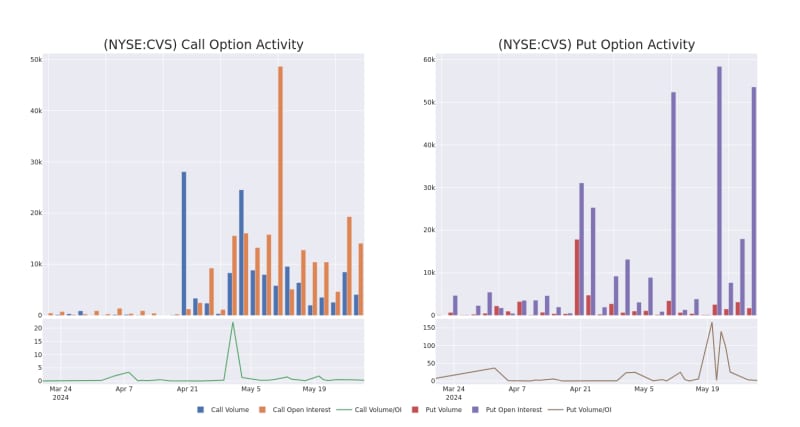

In terms of liquidity and interest, the mean open interest for CVS Health options trades today is 4832.14 with a total volume of 5,820.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for CVS Health's big money trades within a strike price range of $47.5 to $65.0 over the last 30 days.

CVS Health 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

About CVS Health

CVS Health offers a diverse set of healthcare services. Its roots are in its retail pharmacy operations, where it operates over 9,000 stores primarily in the us. CVS is also a large pharmacy benefit manager (acquired through Caremark), processing about 2 billion adjusted claims annually. It also operates a top-tier health insurer (acquired through Aetna) where it serves about 26 million medical members. The company's recent acquisition of Oak Street adds primary care services to the mix, which could have significant synergies with all its existing business lines.

Having examined the options trading patterns of CVS Health, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of CVS Health

- With a trading volume of 16,007,688, the price of CVS is up by 4.43%, reaching $56.05.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 62 days from now.

Expert Opinions on CVS Health

In the last month, 5 experts released ratings on this stock with an average target price of $65.4.

- An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on CVS Health, which currently sits at a price target of $60.

- An analyst from Mizuho persists with their Buy rating on CVS Health, maintaining a target price of $72.

- An analyst from Barclays persists with their Equal-Weight rating on CVS Health, maintaining a target price of $63.

- An analyst from Goldman Sachs has decided to maintain their Buy rating on CVS Health, which currently sits at a price target of $74.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Neutral with a new price target of $58.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest CVS Health options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.