Investors with a lot of money to spend have taken a bullish stance on Analog Devices (NASDAQ:ADI).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ADI, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 16 options trades for Analog Devices.

This isn't normal.

The overall sentiment of these big-money traders is split between 43% bullish and 37%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $97,934, and 15, calls, for a total amount of $3,356,477.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $200.0 to $240.0 for Analog Devices during the past quarter.

Volume & Open Interest Trends

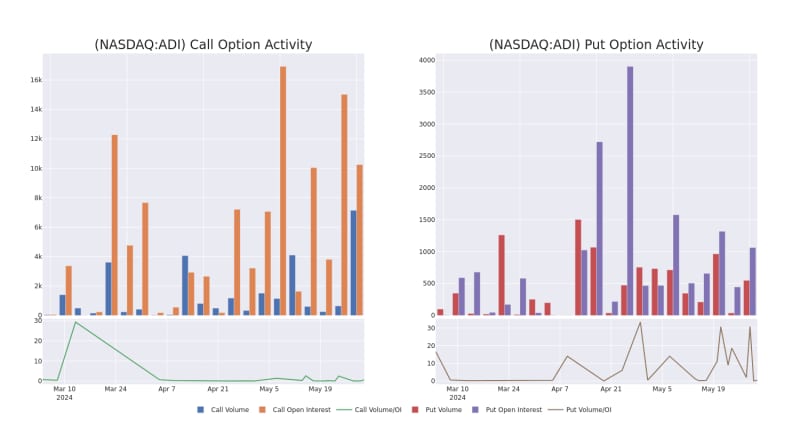

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Analog Devices's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Analog Devices's substantial trades, within a strike price spectrum from $200.0 to $240.0 over the preceding 30 days.

Analog Devices Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

About Analog Devices

Analog Devices is a leading analog, mixed signal, and digital signal processing chipmaker. The firm has a significant market share lead in converter chips, which are used to translate analog signals to digital and vice versa. The company serves tens of thousands of customers, and more than half of its chip sales are made to industrial and automotive end markets. Analog Devices' chips are also incorporated into wireless infrastructure equipment.

After a thorough review of the options trading surrounding Analog Devices, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Analog Devices

- With a trading volume of 1,577,567, the price of ADI is down by -0.7%, reaching $228.4.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 82 days from now.

What The Experts Say On Analog Devices

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $250.0.

- Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Analog Devices with a target price of $275.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Analog Devices, targeting a price of $260.

- Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Analog Devices with a target price of $210.

- An analyst from TD Cowen persists with their Buy rating on Analog Devices, maintaining a target price of $270.

- Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Analog Devices with a target price of $235.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Analog Devices, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.