Whales with a lot of money to spend have taken a noticeably bullish stance on Illumina.

Looking at options history for Illumina (NASDAQ:ILMN) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 12% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $439,557 and 3, calls, for a total amount of $140,370.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $105.0 and $160.0 for Illumina, spanning the last three months.

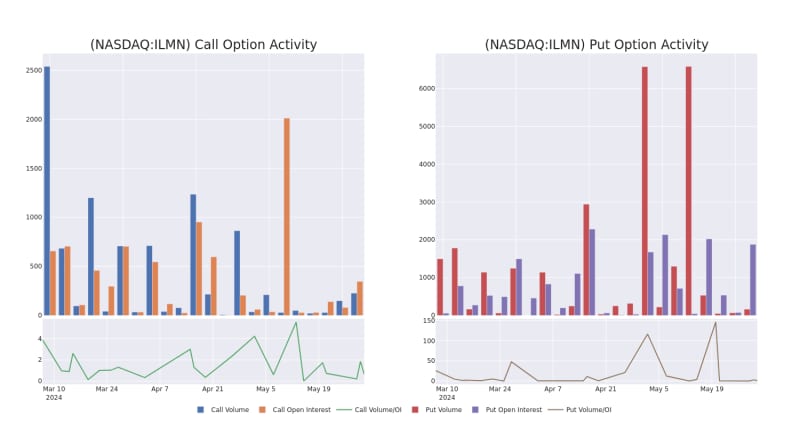

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Illumina's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Illumina's whale trades within a strike price range from $105.0 to $160.0 in the last 30 days.

Illumina Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

About Illumina

Illumina provides tools and services to analyze genetic material with life science and clinical lab applications. The company generates over 90% of its revenue from sequencing instruments, consumables, and services. Illumina's high-throughput technology enables whole genome sequencing in humans and other large organisms. Its lower throughput tools enable applications that require smaller data outputs, such as viral and cancer tumor screening. Illumina also sells microarrays (9% of 2023 sales) that enable lower-cost, focused genetic screening with primarily consumer and agricultural applications.

Following our analysis of the options activities associated with Illumina, we pivot to a closer look at the company's own performance.

Present Market Standing of Illumina

- With a trading volume of 1,312,731, the price of ILMN is up by 2.86%, reaching $103.94.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 68 days from now.

What Analysts Are Saying About Illumina

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $158.0.

- An analyst from Baird persists with their Neutral rating on Illumina, maintaining a target price of $128.

- An analyst from Scotiabank has decided to maintain their Sector Outperform rating on Illumina, which currently sits at a price target of $176.

- An analyst from Stephens & Co. downgraded its action to Overweight with a price target of $170.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Illumina with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.