While both Apple (AAPL) and Nvidia (NVDA) are “Magnificent 7” constituents, their fortunes have diverged over the last year. Nvidia was the best-performing name among the elite group in 2023, and is holding on to the title this year, too. Apple, the worst-performing Magnificent 7 stock last year (despite its 49% gain), is the second worst performer in 2024.

While Apple stock has rebounded from its 2024 lows, the shares are just barely positive YTD, up less than 1% at Monday's close. Notably, Nvidia’s market cap threatened to surpass Apple last month, before the chip designer's post-earnings rally cooled. As for Apple, the iPhone maker has yet to reclaim its $3 trillion market cap, as well as its long-held status as the world’s largest company, which it lost to Microsoft (MSFT) last year.

What’s driving this divergence in Apple and Nvidia, and which of these is a better AI stock to buy now? We’ll discuss in this article.

Why Has the Performance of Apple and Nvidia Diverged?

Stock prices eventually reflect a company’s earnings and growth outlook. Apple’s revenues fell YoY in all four quarters in the last fiscal year. It battled slowing iPhone sales last year – particularly in China, where a “resurrected” Huawei is giving the iPhone maker a tough fight.

Nvidia, meanwhile, has been a breakout growth story, and its revenues rose 126% in the last fiscal year. While the fiscal years of Apple and Nvidia don’t overlap, the numbers nonetheless reflect the divergence in their growth.

Nvidia is the biggest beneficiary of artificial intelligence (AI) spending, and analysts expect it to post revenues of $119 billion in the current fiscal year - nearly 11x what it posted in fiscal year 2020. The company’s revenues are expected to nearly double YoY in the current fiscal year, while Apple’s revenues are expected to rise just about 1%.

Apple Is Viewed as an AI Laggard

While Nvidia has been all about AI since its fiscal Q1 2024 earnings were released in May 2023, Apple was seen as lagging in its AI efforts. The magic words of “AI” barely featured in Apple’s earnings calls. Apple CEO Tim Cook finally talked about AI during the fiscal Q1 2025 earnings call in February, and teased more details on that space “later” in the year.

During the fiscal Q2 earnings call, Cook said that the company is “very bullish about our opportunity in generative AI.” He added, “We believe in the transformative power and promise of AI, and we believe we have advantages that will differentiate us in this new era.”

Apple or Nvidia: Which Stock Is a Better Buy?

Deepwater Asset Management managing partner Gene Munster believes that Apple will outperform Nvidia over the next year.

While the noted tech analyst termed Nvidia CEO Jensen Huang as the “godfather of AI” he told CNBC, “Investors are largely in denial about what Apple’s AI opportunity is going to be.”

Stock Forecast: AAPL Versus NVDA

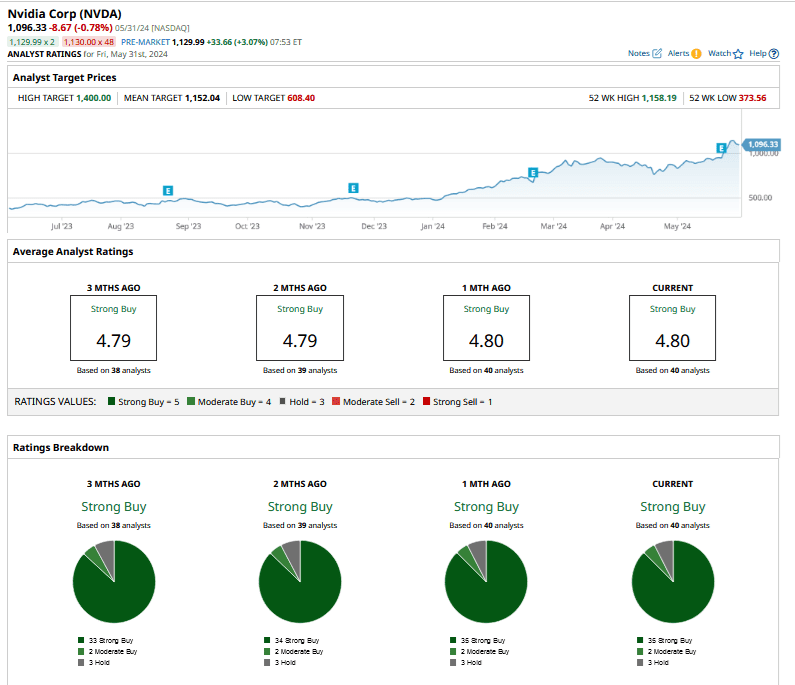

Overall, analysts are more bullish on Nvidia stock.

Apple has a consensus rating of “Moderate Buy,” as two-thirds of the analysts covering the stock rate it as a “Strong Buy” or “Moderate Buy.” 30% of analysts covering Apple rate it as a “Hold,” while one has rated it as a “Strong Sell.”

Nvidia, on the other hand, has a consensus rating of “Strong Buy,” and over 92% of analysts covering the stock rate it as a “Strong Buy” or “Moderate Buy.” The remaining analysts recommend a “Hold” or some equivalent.

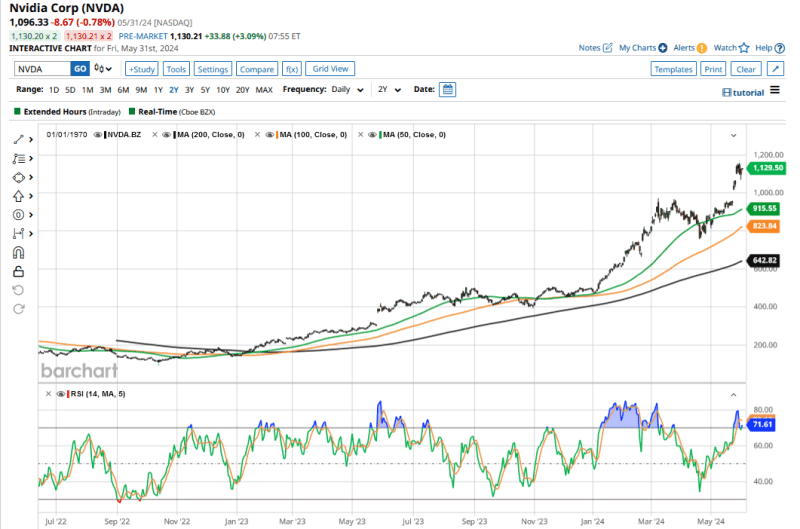

Apple has a mean target price of $205.96, which is 6.1% higher than Monday's close - whereas Nvidia now trades nearly flat with its mean target price of $1,152.04 after its rally to start the week. Amid its spectacular price action over the last year, Nvidia has often traded above its consensus target prices, and analysts have tried to play catch-up following every earnings report by raising their target prices.

Several analysts raised Nvidia’s target price after the fiscal Q1 earnings last month. For instance, Benchmark analyst Cody Acree raised his target price from $1,000 to $1,320, while Bank of America’s Vivek Arya raised his from $1,100 to $1,320.

Can Apple Stock Outperform Nvidia?

To be sure, Munster is not the only analyst who is bullish on Apple's AI opportunity. JP Morgan analyst Samik Chatterjee believes that AI could lead to a major iPhone upgrade cycle of the kind we saw with 5G.

Apple might unveil new products or enhancements to its existing portfolio at the Worldwide Developers Conference (WWDC), which is scheduled for June 10-14. As generative AI becomes more mainstream, we could see a supercycle in hardware sales, especially after tepid sales over the last year. Incidentally, HP (HPQ) stock surged last week after the company sounded optimistic that the introduction of AI PCs would fuel a PC refresh cycle.

All said, I would side with Munster, and see Apple outperforming Nvidia over the next year - predominantly because of Nvidia’s rich valuations, which don’t leave much on the table, at least not for the short to medium term.

On the date of publication, Mohit Oberoi had a position in: NVDA , AAPL , MSFT . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.