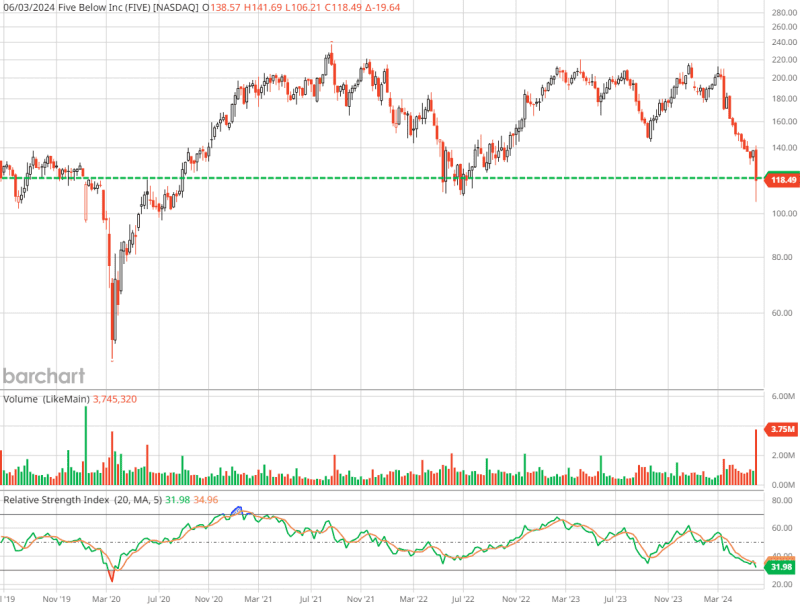

Based on the face-value interpretation of unusual stock options volume against discount retailer Five Below (FIVE), one may be tempted to jump ship. Following a disappointing financial disclosure, FIVE stock ended up losing over 14% of equity value in the business week ending June 7. But is that really the end of the story?

If we explore the fundamentals and the financial history of Five Below, the severe bout of red ink would suggest that – at least for the contrarian bulls – FIVE stock offers a possible upside opportunity. Granted, it’s risky: no one’s saying that it’s not. However, relevant businesses (especially those that have robust support from Wall Street analysts) should generally turn their circumstances around.

The same can potentially happen for Five Below but investors will need to plug their nose for a bit. Much of the volatility centered on the retailer’s poor results for its first quarter. While revenue jumped 12% to $811.9 million, this tally stemmed from Five opening new stores. By looking at comparable sales growth, sales actually slipped 2.3% year-over-year.

Further, Barchart content partner The Motley Fool states that in the quarter, “the company's operating income declined from $42.4 million to $36.2 million despite having a larger overall revenue number. Things will likely look worse throughout 2024. Management is guiding for comparable sales growth of negative 3% to negative 5% for the full fiscal year, which would be a deterioration from Q1.”

Even more problematic, management anticipates that fiscal 2024 sales may land between $3.79 billion and $3.87 billion. That’s a step down from Five Below’s prior guidance, which called for $3.97 billion and $4.07 billion. Adding insult to injury, comparable sales may slip between 3% and 5%.

Obviously, that’s not a great look. However, for long-term investors, FIVE stock could be an intriguing bullish pickup.

Big Players Place Heavy Bets Against FIVE Stock

Fundamentally, Five Below is supposed to provide compelling bargains across the income spectrum, but especially for households with more modest means. When considering comparable sales, the company is missing the mark. However, it’s also risky in my opinion to go heavily bearish against FIVE stock.

However, that’s what the smart money appears to be doing. Following the close of the June 7 session, total volume for FIVE stock options reached 15,730 contracts against an open interest reading of 57,449. Friday’s volume represented a 216.75% lift from the trailing one-month average metric. Also, call volume reached 7,549 contracts versus put volume of 8,181.

It’s in Barchart’s options flow screener where circumstances get spicy. Options flow targets big block transactions exclusively, meaning that they’re most likely placed by institutional investors. Net trade sentiment sits at $715,600 below parity, thus favoring the bears.

Tellingly, the most bullish trade was for sold JUN 21’24 150.00 puts, which featured a premium of $120,900. On the other hand, the most bearish trade was for acquired JUL 19’24 160.00 puts, which featured a premium of $822,000.

Despite the imbalance of premiums favoring the pessimists, FIVE stock appears to be a long-term buying opportunity. First, it comes down to the fundamentals. While Five Below may be struggling, households across America – unless they’re wildly wealthy – are feeling the pain of inflation. Further, wages haven’t kept pace with sharply rising costs of living.

That doesn’t suddenly make FIVE stock a sterling opportunity. However, the point is that the luxury consumer discretionary space isn’t experiencing a renaissance of booming demand. People still need to save money. Five Below has always specialized in discount retailing.

Another factor is that management noted demand increases for essential products, such as food and cosmetic lines. These sales helped bolster the overall top line. That also tells me that, while Five Below may be hurting, it’s probably in a relatively good position over the long run.

If people are struggling to afford food at discount retailers, they’re probably not going to acquire it from premium outlets.

Five Below (Like Its Business Model) Represents a Discount

Finally, the last element to keep in mind about FIVE stock is the valuation. Priced at 1.81X trailing-year revenue, the discount retailer isn’t exactly cheap. The underlying specialty retail sector runs an average sales multiple of 0.85X.

Here’s the thing. At the lowest end of analysts’ sales expectations for fiscal 2024 (which comes out to $3.81 billion), revenue would still expand by 7% from last year’s tally of $3.56 billion. If so, based on the shares outstanding count of 55.19 million, FIVE stock is trading at 1.73X projected sales.

Should the company hit the high end of the spectrum ($4.07 billion), the multiple would slip some more to 1.61X. Yes, that’s still hotter than the sector average but Five Below does deserve to command a premium because of its popularity.

Not only that, in years past, it wasn’t uncommon for the revenue multiple to run at 3X or above. Right now, FIVE stock is the cheapest you can acquire shares based on sales valuations. That’s not something to ignore. That’s also not something to short.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.