Short-selling can be an effective way for market participants to make money on stocks that they expect to decline in price. Still, when short-selling activity occurs en masse, it is not so pleasant for the company whose stock is the subject of all that bearish speculation.

In the simplest terms, short-selling is an investment strategy that allows investors to profit from a decline in a stock's price. It typically involves borrowing shares of that company's stock from a broker, often on margin, to sell on the open market. The expectation is that the investor will be able to buy back those shares at a lower price in the future, allowing the investor to pocket the difference in price as the profit on the trade.

We often think about highly speculative stocks and meme trades when we think about short selling. However, heavy short-selling activity in a stock with improving fundamentals, that's operating in a growing industry, and with recent bullish coverage from well-regarded brokers might seem a bit perplexing. However, that is exactly what is happening with Confluent (CFLT).

Shorts Target Confluent Stock

According to data and tech firm Hazeltree, Confluent (CFLT) was the most shorted U.S. mid-cap stock in May. The security garnered a Hazeltree Crowdedness Score of 99, signifying a high degree of shorting among the funds tracked by the data firm.

Founded in 2014 and based out of Mountain View, Calif., Confluent develops and provides a platform for event streaming, focused on Apache Kafka, an open-source project the founders created on LinkedIn. Kafka allows companies to ingest and process real-time data streams, enabling them to react to events and make data-driven decisions faster. Its market cap currently stands at $8.83 billion.

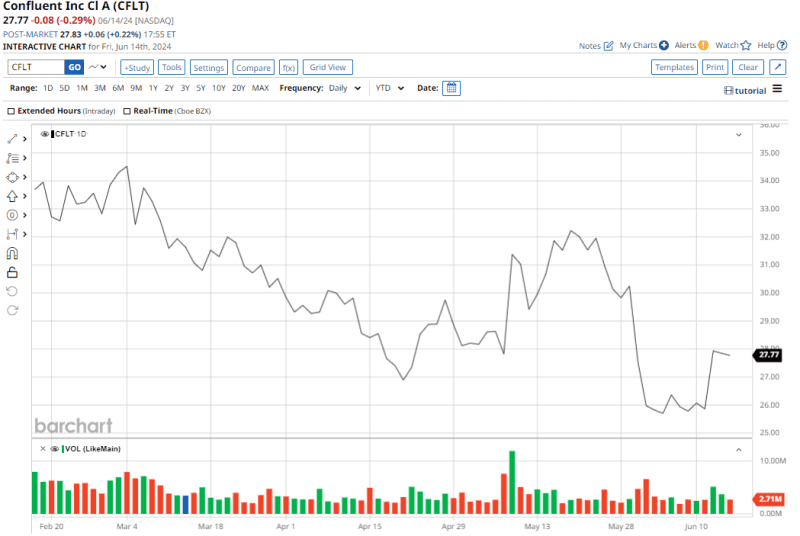

Despite the heavy shorting activity last month, CFLT stock is up 18.8% on a YTD basis, besting the broader equities market.

According to Nasdaq (NDAQ) data, as of May 31, it would take nearly six trading days, at Confluent's average daily volume, for all of the outstanding shorted shares to be covered.

Now, let's have a closer look at some of the bullish catalysts that could shake loose those CFLT short sellers.

Solid Q1 Results

Confluent's numbers for the first quarter came in above expectations on revenue, as well as on the earnings front. Revenues for the quarter came in at $217 million, up 25% year over year, led by 29% growth in subscription revenues to $207 million.

Customers with greater than $100,000 in annual recurring revenue (ARR), a key metric for platform companies, went up by 17% on a YoY basis to 1,260 customers.

Over the past three years, the company's revenues have clocked a CAGR of 46.1%. Consequently, analysts are targeting forward revenue growth for Confluent at 26.8%, compared to the sector median of 6.72%.

The company also reported Q1 EPS of $0.05, compared to a loss of $0.09 per share in the prior year. The quarterly profit came in above the consensus estimate for an EPS of $0.02. Over the past five quarters, Confluent's bottom line has exceeded expectations each time.

Confluent exited the quarter with a cash balance of $336.37 million, much higher than its short-term and long-term debt levels of $10.06 million and $13.28 million, respectively.

Management's fiscal year 2024 outlook remains optimistic, with total revenue projected to reach approximately $957 million. This includes a robust subscription revenue stream forecast of around $910 million, indicating strong customer adoption of their platform. EPS is expected to be between $0.19 to $0.20 for the period.

A Key Player in an Exciting Market

According to this report, the global streaming analytics market size is projected to grow from $27.8 billion in 2024 to $185.1 billion by 2032, which represents a CAGR of 26.7%. And to capture this market, Confluent is making some notable moves.

Confluent provides two core products catering to different deployment needs: Confluent Platform and Confluent Cloud. The Confluent Platform is a self-managed solution ideal for on-premise deployments, with access granted through annual or multi-year subscriptions. For cloud-based deployments, Confluent Cloud offers a fully managed, cloud-native solution with a combined usage-based and subscription pricing model.

Beyond its core products, Confluent is known for ongoing advancements. Features like Tableflow and Flink, recently highlighted by CEO Jay Kreps, enhance data integration and processing capabilities. This focus on innovation extends to their recent strategic move: unifying data streaming and processing with Apache Flink. This positions Confluent's platform as the industry's fastest and most secure choice for developers, particularly those building next-generation artificial intelligence (AI) applications requiring real-time processing.

Furthermore, Confluent is strategically shifting its Confluent Cloud sales model towards a consumption-based approach. This includes revamping sales compensation to prioritize customer acquisition and efficient conversion to paid users, while also driving platform expansion through new use cases.

Solidifying its leadership position, Confluent remains the leader in Kafka, the open-source foundation for its platform and the industry standard for real-time data streaming.

Analysts Stay Bullish on CFLT

Top brokers like Evercore and Oppenheimer are bullish on the Confluent stock. While Evercore recently initiated coverage on the stock with an “Outperform” rating and a $35 target price, Oppenheimer last month hailed Confluent as a “disruptive innovator.”

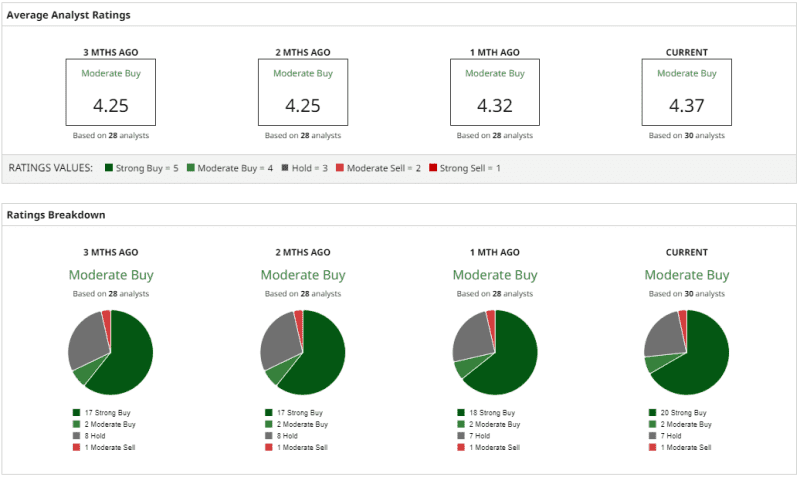

Overall, the analyst community is cautiously optimistic about CFLT stock, which has an average rating of “Moderate Buy” with a mean target price of $34. This indicates an upside potential of about 22.3% from current levels.

Out of 30 analysts covering the stock, 20 have a “Strong Buy” rating, 2 have a “Moderate Buy” rating, 7 have a “Hold” rating, and 1 has a “Moderate Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.