In a current market cycle where relevant technology firms are storming out of the gates, it’s compelling to find ideas that most others simply don’t appreciate. With digital advertising specialist Taboola.com (TBLA), Wall Street may be overlooking the criticality of the business.

Over the years, the physical print media ecosystem has been rapidly fading in favor of online content. It’s not that the traditional medium is completely irrelevant. However, with the wide proliferation of smart phones and other connected devices, it’s just easier for media enterprises to broadcast their material on the web.

However, print media generally carried the advantage of transactional linkage. In other words, if you wanted to take home the book or magazine, you had to pay for it. But in the contemporary paradigm, anyone can disseminate information, thereby disrupting the major publishing houses. Still, in the long run, no media enterprise can afford to not get paid.

That’s where Taboola comes into the frame. Leveraging artificial intelligence, the company utilizes various marketing protocols to drive monetization and user engagement. Those advertisements that you see at the bottom of popular news websites? Chances are, you’re dealing with Taboola-generated ads.

Through the enterprise’s proprietary algorithms, these ads are tailored to website visitors surfing habits, enhancing opportunities for click-throughs and sales conversions. That’s great for online content publishers while keeping advertisers happy.

Since content will probably continue operating within the digital realm, online advertising solutions should be relevant indefinitely. As a result, TBLA stock natively makes for an intriguing buying idea.

TBLA Stock Identified as a Technical Discount

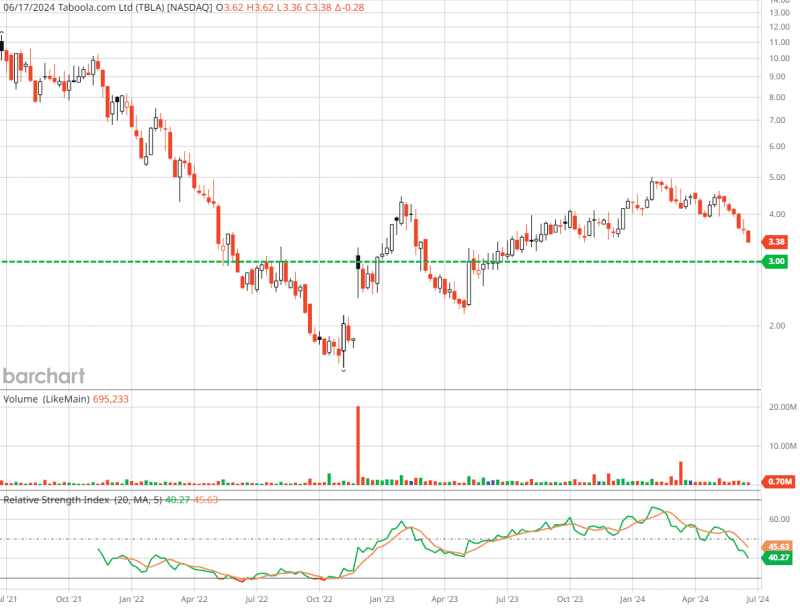

Despite the relevancies that Taboola has to offer, the market doesn’t exactly concur with the optimistic framework. For example, since the start of this year, TBLA stock slipped almost 20%. In the past five sessions, the volatility has been particularly intense, with shares down nearly 11%. Unless the red ink is mitigated soon, TBLA risks returning to parity over the past 52 weeks.

Still, the downside action may have a silver lining. Recently, the RSI Oversold indicator – one of the tools found in Barchart’s Stocks Screener section – identified TBLA stock as a possibly oversold security. Per the website, the “20-Day [relative strength indicator] indicates these high volume stocks are in an oversold territory. When the RSI goes below the 30 level, the common interpretation is that the trend may reverse upwards.”

Depending on the time frame set in the interactive chart, the RSI indicator will fluctuate. However, using the trailing-month frame, the present RSI shows as 29.23, thus triggering the Oversold indicator. The last time the RSI was this low was on June 4. Two days later, TBLA stock shot robustly higher. Therefore, this signal may provide near-term speculative trading guidance.

However, what may be more compelling is the longer-term framework. Based on the trailing three-year period, the RSI for TBLA stock sits at 40.27, which is relatively oversold compared to prior months. Just as significantly (if not more so), as Taboola is broadcasting excessive selling pressure, TBLA is approaching the critical $3 level.

In the past, this line represented both support and upside resistance. Therefore, it’s only natural that the bears are attempting to drive TBLA stock to and potentially below this threshold. However, with the RSI indicating an abnormal magnitude of selling pressure, the bulls may soon move into the market.

That’s why I anticipate a massive battlefront as TBLA stock approaches $3. Exhausted after much fighting, the bulls have an arguably good chance of converting defense into a powerful offense.

Financials Make a Compelling Case for Taboola

Another element that works in favor of TBLA stock is the financials. Based on expert projections, Taboola is an undervalued investment. The present volatility only makes the contrarian bullish argument all the more enticing.

Right now, TBLA stock trades at a trailing-year sales multiple of 0.78X. Admittedly, it’s difficult to classify the underlying enterprise. However, the related advertising agency sector feature an average revenue multiple of 1.25X. If we were to assess Taboola as a software firm, the average for that sector runs between 3.71X to 3.75X.

Either way, TBLA stock appears undervalued. Not only that, analysts on average project the underlying enterprise to print sales of $1.91 billion. That would be up 33% from last year’s tally of $1.44 billion. More importantly, if this forecast holds true, TBLA would be trading at only 0.51X projected revenue (assuming a shares outstanding count of 290.73 million).

You know what’s even more wild? The least optimistic sales forecast calls for $1.86 billion. That would still be up 29% from last year’s revenue haul and shares would be trading at 0.53X projected sales. Even with the “pessimistic” view, TBLA stock appears to be a discount.

Fundamentally, that arguably makes logical sense. Again, content is moving rapidly toward the online sphere and there doesn’t seem to be a reversal coming anytime soon, if ever. Therefore, TBLA stock – while being high risk – presents a credible case of an oversold security that could bounce higher.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.