Wagering on artificial intelligence (AI) stocks to buy has been a major theme in the stock market in the past year. AI emerged as Wall Street's standout trend in 2023 on the back of OpenAI's ChatGPT breakout success. Last year's narrow market saw the “Magnificent Seven” spearhead gains for the S&P 500 Index ($SPX), driven by investors' enthusiasm for AI.

With the S&P 500 still reaching record highs, investors are eager to capitalize on the rally in growth stocks and the growing enthusiasm for AI technologies - but now, the real challenge is pinpointing the genuine AI winners that are poised for substantial long-term growth.

In the current environment, the concerns of some market-watchers about AI's tangible potential are valid. Investors now need to ask themselves, how big of an impact will AI have on a company's revenues, earnings, cash flows, and other key metrics?

Of course, these are only a few questions for investors to consider as they contemplate the next best stocks to buy in artificial intelligence. With that said, let's identify the top three AI stocks that promise to not only navigate the hype, but also offer long-term upside potential. Here are three companies that I feel have moved beyond the hype phase, and are now showing Wall Street how generative AI is impacting their fundamentals.

#1. Microsoft

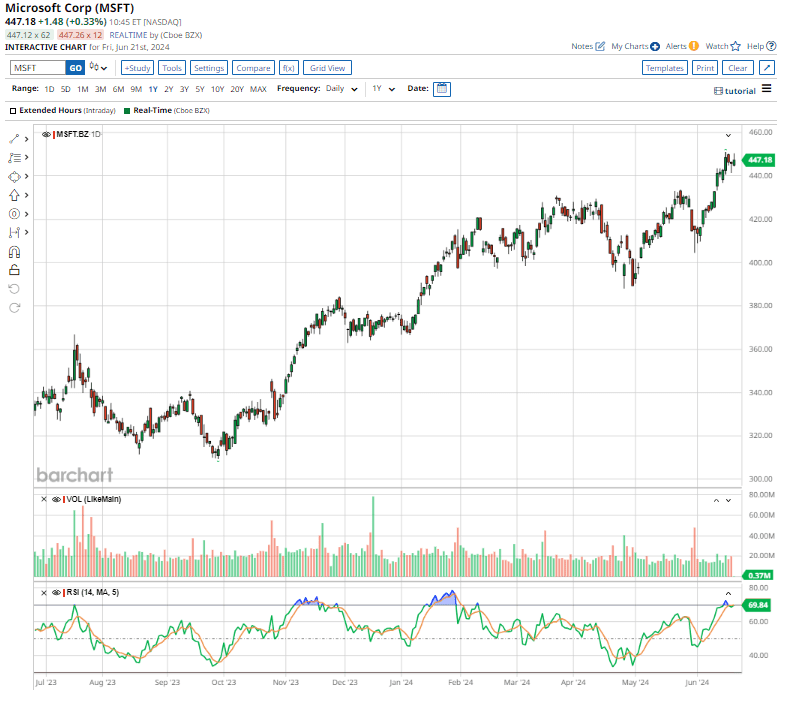

Valued at $3.3 trillion, Microsoft's (MSFT) dominance in AI led the stock to record gains last year. Its massive investments in game-changing technology through OpenAI were arguably the biggest story from the stock market last year.

Consequently, MSFT investors were rewarded handsomely in the process, with its stock gaining 34.2% over the past year, compared to the S&P 500's gain of 25.2%.

Though Microsoft has layered AI throughout its software suite and introduced novel new products, such as Copilot, it looks like we are just getting started.

Microsoft delivered strong results in its latest fiscal Q3 earnings print, with revenue reaching $61.8 billion, indicating 17% growth year over year. Similarly, Q3 net profit rose by 19.85%, hitting $21.9 billion. The company reported earnings per share of $2.94, beating analysts' expectations by 3.4%.

Looking ahead, Microsoft has pledged north of $2.2 billion in future cloud and AI investments in Malaysia, and has made key investments in AI startups, like France's Mistral. This should result in more top- and bottom-line beats for the business as it ushers in a new era of expansion.

Microsoft's earnings are projected to increase roughly 20% this fiscal year, and 12% in fiscal 2025. Notably, the stock also pays a quarterly dividend of $0.75 per share, offering a forward yield of 0.67%.

Wall Street analysts have taken a bullish stance on Microsoft stock, given the consensus rating of "strong buy," with a mean price target of $492.71. Out of 38 analysts, 34 have assigned a "strong buy" rating, 3 have given a "moderate buy" rating, and 1 calls it a "hold." The stock has 10% upside potential to its mean price target.

#2. Amazon

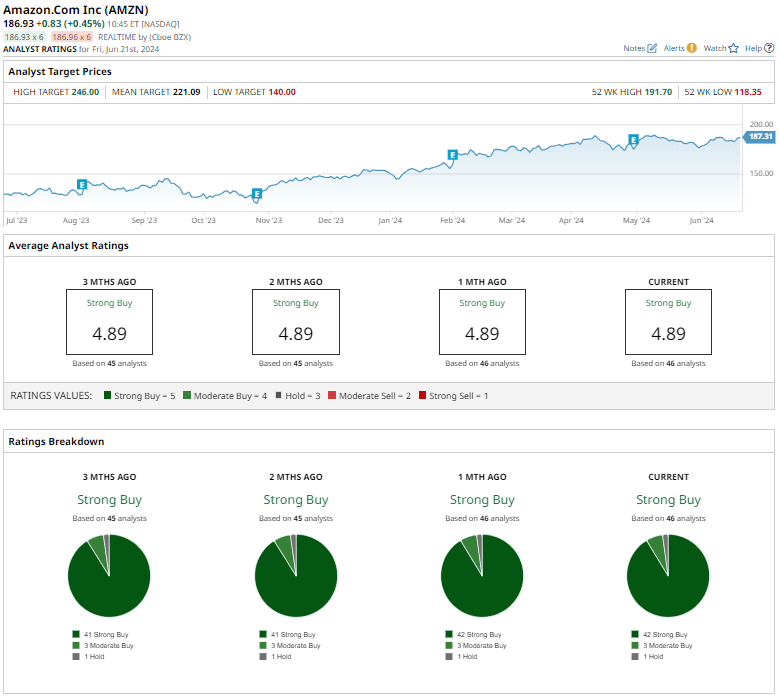

Tech giant Amazon (AMZN) has flown under the radar regarding its AI initiatives. I guess the market’s focus has been more on Amazon Web Services (AWS), its powerful cloud computing arm that never ceases to amaze. However, as AWS grows by stellar margins each quarter, investors may overlook its AI-led potential. Moreover, the implications of AWS and AI are massive and could potentially add millions in incremental sales for Amazon going forward.

Amazon’s AI story can be linked to its $4 billion investment in Anthropic AI, the brains behind the disruptive Claude AI chatbot. According to Anthropic, its powerful AI chatbot can surpass Gemini and ChatGPT across multiple benchmarks. That suggests the potential of Claude AI and Amazon’s suite of services, especially AWS, can be massive.

Valued at $1.9 trillion by market cap, shares of Amazon have soared over 50% in the last 52 weeks, outperforming the broader market.

On the financial front, Amazon continues to impress, posting another quarter of revenue and earnings beats. Q1 sales increased by 13% year over year, reaching $143.3 billion. Similarly, net income ramped up to $10.4 billion, making a staggering jump of 228% year over year. The company reported adjusted EPS of $1.13 per share, easily beating analysts' expectations.

In terms of valuation, Amazon is trading at 41x forward earnings. It's not cheap, but it's worth investing in based on its tremendous untapped AI potential.

On Wall Street, Amazon has received a consensus “strong buy” rating, with the mean price target of $221.09 reflecting 18% upside potential. Among 46 analysts, 42 call it a “ strong buy,” 3 maintain a ”moderate buy," and 1 recommends a “hold."

#3. Baidu

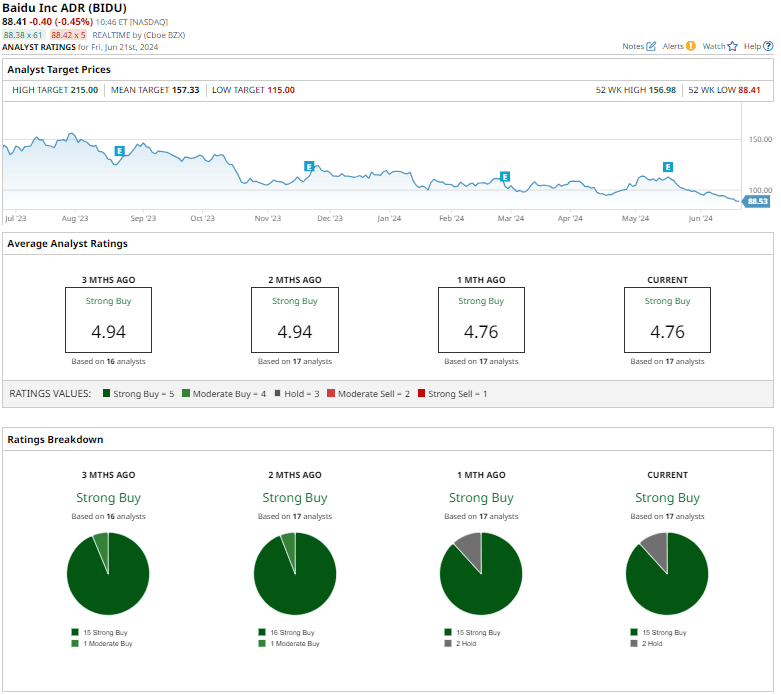

Often described as China’s answer to Google, Baidu (BIDU) has been a true juggernaut in the Chinese tech space. It operates the largest search engine in China, among a swath of other services, positioning it for powerful long-term gains. Baidu has a robust market capitalization of $31.1 billion.

Despite beating sales and earnings estimates in the first quarter of 2024, BIDU shares are down by 37% over the past year, due in part to broader market headwinds for Chinese stocks.

The company reported Q1 revenue of $4.37 billion, beating analysts' expectations even as its top line decreased by 3.7% year over year. Net income reached $754 million, a 106% jump from the previous quarter. Baidu's earnings per share of $2.75 topped estimates by 25.9%.

Despite some delays on the road to its launch, Baidu's powerful Ernie bot recently surpassed 200 million users, a testament to its incredible appeal. Moreover, the company has released many other AI tools, including new iterations of the Ernie Bot, to solidify its position further.

Additionally, another major catalyst for the firm could be tech giant Apple (AAPL) reportedly reaching out to Baidu to use its proprietary AI technology in its iPhones to overcome local regulatory hurdles, though a partnership has not been confirmed.

There’s plenty to cheer over with BIDU stock, especially considering Wall Street analysts have given it a consensus rating of “ strong buy.” Among 17 analysts, 15 call it a “ strong buy,” while 2 suggest a” hold” rating. The stock has a mean price target of $157.33, indicating a 78% upside potential.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.