Financial giants have made a conspicuous bearish move on Chipotle Mexican Grill. Our analysis of options history for Chipotle Mexican Grill (NYSE:CMG) revealed 46 unusual trades.

Delving into the details, we found 30% of traders were bullish, while 69% showed bearish tendencies. Out of all the trades we spotted, 28 were puts, with a value of $1,751,348, and 18 were calls, valued at $811,067.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2085.0 to $3300.0 for Chipotle Mexican Grill over the recent three months.

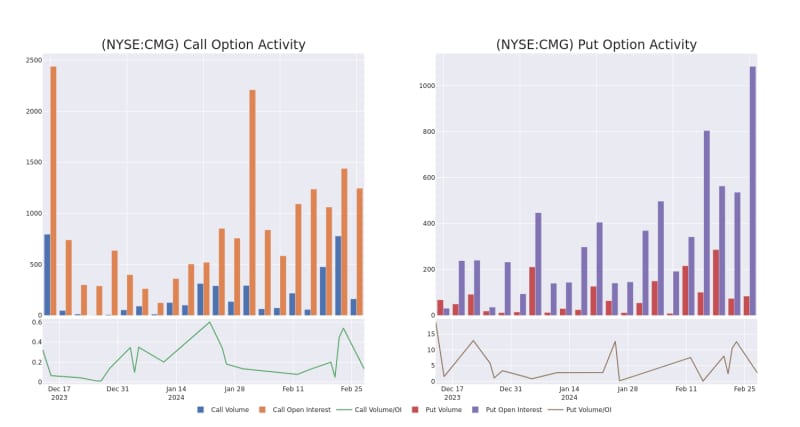

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Chipotle Mexican Grill's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Chipotle Mexican Grill's whale activity within a strike price range from $2085.0 to $3300.0 in the last 30 days.

Chipotle Mexican Grill Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

About Chipotle Mexican Grill

Chipotle Mexican Grill is the largest fast-casual chain restaurant in the United States, with systemwide sales of $9.9 billion in 2023. The Mexican concept is predominately company-owned (it recently inked a development agreement with Alshaya Group in the Middle East), with a footprint of nearly 3,440 stores at the end of 2023, heavily indexed to the United States, although the firm maintains a small presence in Canada, the U.K., France, and Germany. Chipotle sells burritos, burrito bowls, tacos, quesadillas, and beverages, with a selling proposition built around competitive prices, high-quality food sourcing, speed of service, and convenience. The company generates its revenue entirely from restaurant sales and delivery fees.

In light of the recent options history for Chipotle Mexican Grill, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Chipotle Mexican Grill's Current Market Status

- Currently trading with a volume of 80,312, the CMG's price is down by 0.0%, now at $2711.33.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 49 days.

What The Experts Say On Chipotle Mexican Grill

In the last month, 5 experts released ratings on this stock with an average target price of $2680.0.

- An analyst from Stifel persists with their Buy rating on Chipotle Mexican Grill, maintaining a target price of $2700.

- Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Chipotle Mexican Grill with a target price of $2400.

- An analyst from TD Cowen persists with their Outperform rating on Chipotle Mexican Grill, maintaining a target price of $2900.

- An analyst from Wedbush downgraded its action to Neutral with a price target of $2400.

- Maintaining their stance, an analyst from Stephens & Co. continues to hold a Overweight rating for Chipotle Mexican Grill, targeting a price of $3000.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Chipotle Mexican Grill, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.