Financial giants have made a conspicuous bearish move on ASML Holding. Our analysis of options history for ASML Holding (NASDAQ:ASML) revealed 68 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 32 were puts, with a value of $2,321,215, and 36 were calls, valued at $1,851,337.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $730.0 to $1280.0 for ASML Holding over the last 3 months.

Insights into Volume & Open Interest

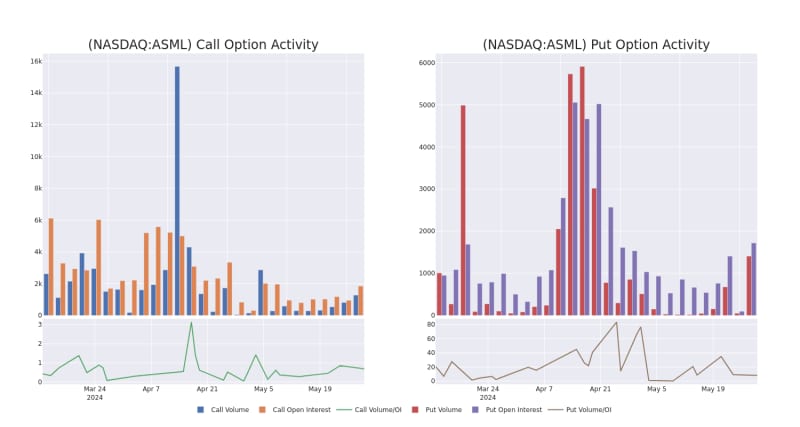

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for ASML Holding's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across ASML Holding's significant trades, within a strike price range of $730.0 to $1280.0, over the past month.

ASML Holding 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

About ASML Holding

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML's main clients are TSMC, Samsung, and Intel.

After a thorough review of the options trading surrounding ASML Holding, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of ASML Holding

- With a volume of 634,455, the price of ASML is down -2.21% at $944.75.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 47 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ASML Holding with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.