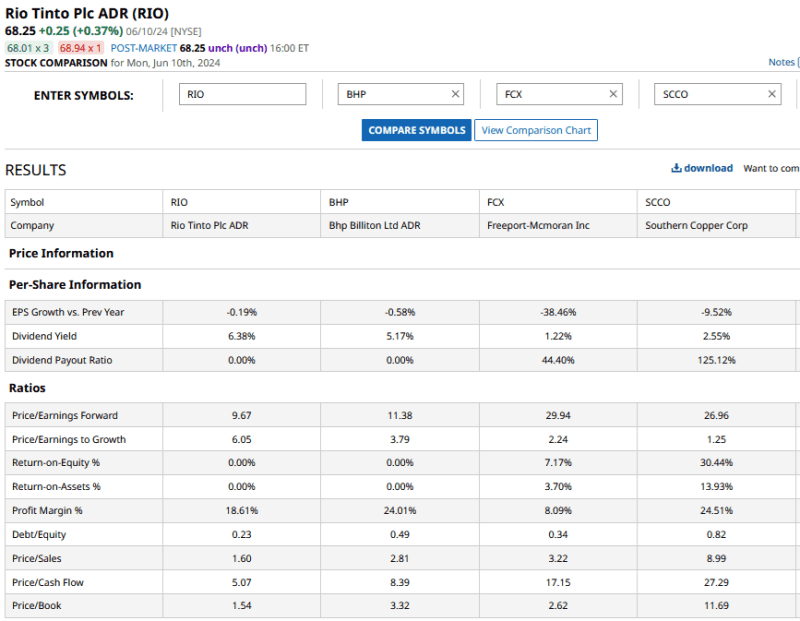

Despite their massive capex, mining companies are known to pay healthy dividends to investors. For instance, currently, BHP Group (BHP) \- which is the world’s largest mining company - has a yield of over 5%, while Rio Tinto (RIO), the second-biggest mining company, yields over 6%.

Is Rio Tinto stock a buy for its fat dividend yield? In this article, we’ll look at the mining giant’s dividend policy and analyze whether it’s a good buy at current prices.

Mining Companies’ Dividend Policy

Until early 2016, both BHP and RIO practiced what was known as a “progressive dividend policy.” Under that policy, they increased dividends every year, or at least tried to pay the same dividend. Importantly, the dividend wasn’t based on the actual profits that they made, and even if profits fell, both of these companies did not cut shareholder payouts.

The dividend policy was problematic in the first place, as mining is quite a cyclical industry. As long-time investors will recall, global commodity prices plummeted in 2015, and hit their nadir in Q1 of 2016. Several mining companies looked at the risk of going out of business, and took desperate measures to survive. Freeport-McMoRan (FCX), for instance, unloaded its energy assets in a fire sale, while also selling a stake in one of its copper mines as it tried to pare its burgeoning debt.

Both BHP and RIO walked away from the progressive dividend policy in 2016, and instead linked payouts to their earnings. RIO intends to pay between 40%-60% of its underlying earnings as dividends over the cycle. Its payout has been at the upper end of the range for the last 8 years since it pivoted to the new dividend policy. BHP has a policy of paying at least half of its underlying attributable profits as dividends at the end of each reporting period.

Rio Tinto Has a Yield of Nearly 6.4%

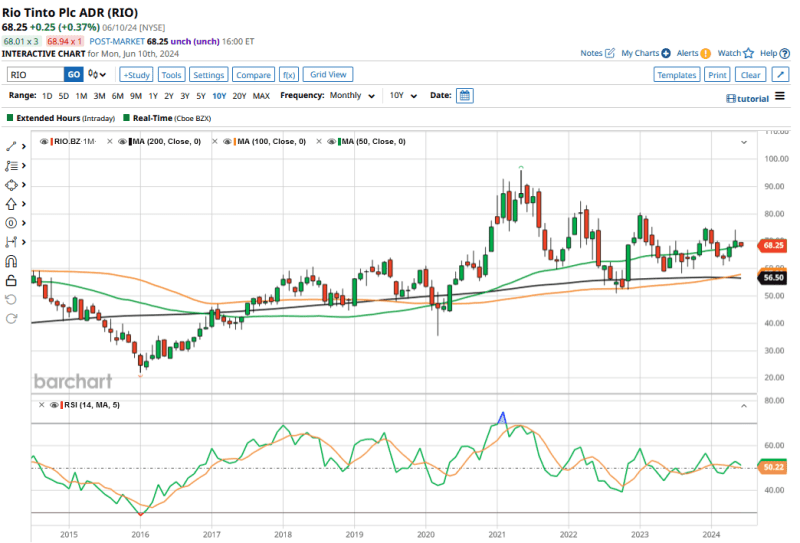

Rio Tinto has a dividend yield of 6.4%, which is quite attractive when compared with the S&P 500 Index ($SPX), whose yield is currently below historical averages. However, like most other high-yielding stocks, Rio Tinto’s price action has been disappointing.

The stock has lost 9.8% YTD in 2024, and has shed almost a sixth of its market cap over the last three years. While Rio is up 25% over the last 10 years, the returns are way below what broader markets have delivered over the period.

Rio Tinto’s earnings are correlated to commodity prices \- especially iron ore, which accounts for the lion’s share of its profits, followed by aluminum (ALQ24) and copper (HGN24).

Global iron ore prices are well below their all-time highs, which is weighing on RIO’s earnings and by extension, its stock price. Iron ore is almost entirely used in steel production, and demand growth has slowed down over the years due to the slowdown in China.

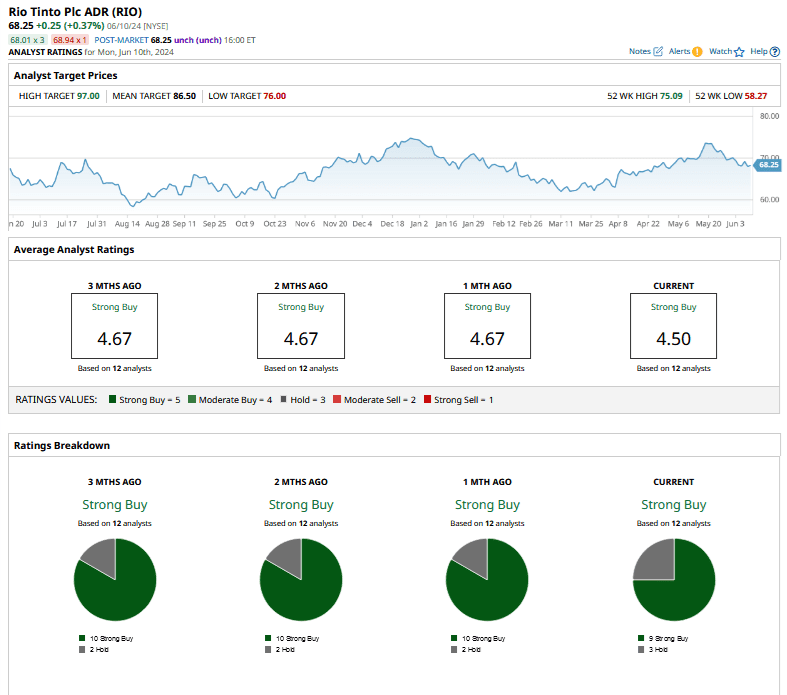

Analysts Rate RIO Stock as a “Strong Buy”

Despite the headwinds in commodity prices, Wall Street analysts are quite upbeat about RIO and rate it as a “Strong Buy.” Of the 12 analysts covering the stock, 9 rate it as a “Strong Buy” and 3 as a “Hold.”

RIO has a mean target price of $86.50, which is 28.7% higher than today’s closing prices. Its Street-high target price is $97, and the stock trades south of even its Street-low target price of $76.

Should You Buy RIO Stock After the Underperformance?

RIO stock trades at a next 12-month (NTM) enterprise value-to-earnings before interest, tax, depreciation, and amortization (EV-to-EBITDA) multiple of 4.8x, which does not look particularly demanding considering the risk-return dynamics. RIO has a strong balance sheet, and had a net debt of only about $4.2 billion at the end of 2023.

Meanwhile, iron ore – which accounted for nearly four-fifths of RIO’s 2023 earnings - is going through a turbulent time. China, and particularly the Chinese construction sector, has been the biggest consumer of steel for decades. However, construction activity has been tepid in the world's second-biggest economy, which has impacted demand for both steel and iron ore.

While steel demand has been strong in India, which has steadily become the world’s second-largest steel producer and consumer, the country’s overall demand is still well below that of China.

Globally, higher interest rates have led to a slowdown in housing and automotive markets, which are the two biggest steel consumers. While RIO is trying to diversify its portfolio, and is looking to increase its copper production, the red metal still accounts for a small fraction of its total revenues and profits.

Overall, while RIO offers an attractive dividend yield, I don’t find the stock a compelling buy at these prices.

On the date of publication, Mohit Oberoi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.