While chip stocks have been the flavor of the season, and names like Nvidia (NVDA) and Broadcom (AVGO) have surged to all-time highs, Intel (INTC) shares have continued to sag. Intel is down 39% YTD, and has been a perennial underperformer.

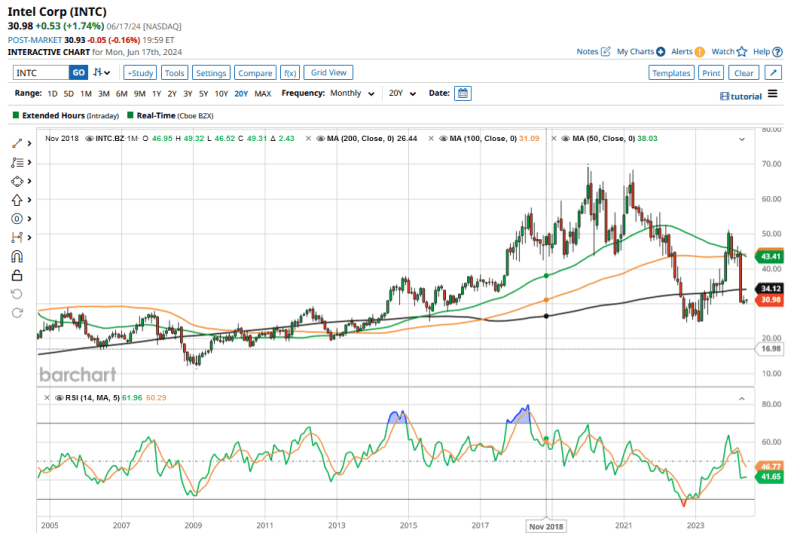

The chip giant is in the red over the last 2 year and 5 year time frames, and is flat over the last decade. It is up around 12% in the last 20 years, but that’s not exactly the kind of performance the company might want to boast about.

Notably, Intel is also among the dot-com era companies that haven’t managed to revisit their all-time highs in nearly 25 years. Specifically, the stock hit a record high of $75.81 on Aug. 23, 2000, and currently trades at less than half of those price levels.

Currently, Intel shares are trading near their 52-week lows at a time when the S&P 500 Index ($SPX) and Nasdaq Composite ($NASX) seem to be hitting record highs almost every day. Is INTC stock a buy now - especially considering its dividend yield of 1.6%, which is much higher than other chip companies? We’ll discuss in this article.

Why Has Intel Stock Been Falling?

Intel stock is falling for a reason, which is primarily its tepid growth. The company's top-line and bottom-line growth have sagged, which is also reflected in its stock price.

For instance, Intel posted revenues and operating income of $52.7 billion and $12.3 billion, respectively, in 2013. After 10 years, in 2023, its revenues were $54.2 billion, while operating income was a mere $93 million. The company’s earnings have been falling gradually, and its operating income was $2.3 billion in 2022, which is less than a fifth of its 2013 operating income.

Intel has missed quite a few buses over the years, including the smartphone (and iPhone) revolution. More recently, Intel - like other chip companies \- lost out to Nvidia, which capitalized on the AI boom.

Also, earlier this year the company revealed that it incurred a massive $7 billion loss in its foundry business in 2023. The business produces chips for Intel, as well as third parties.

INTC Stock Forecast: How Much Upside Do Analysts See?

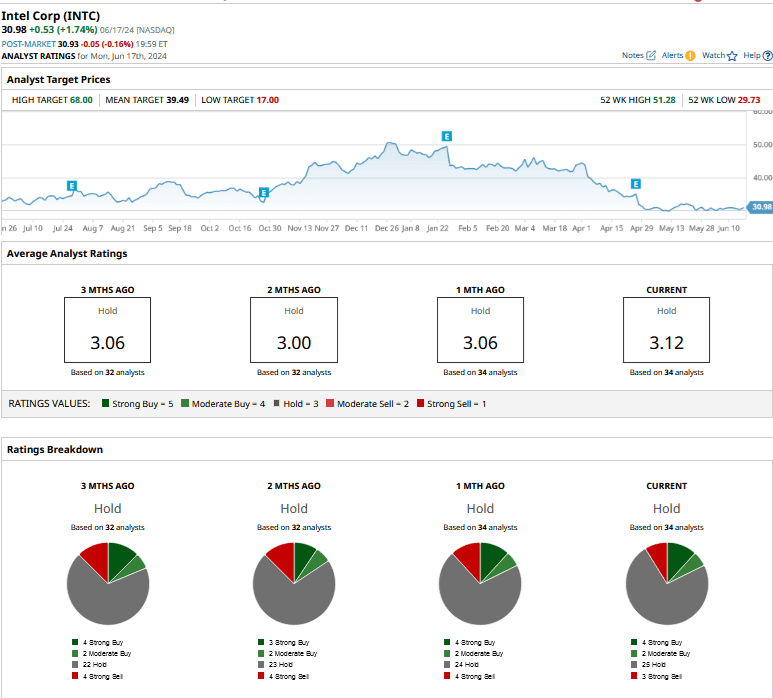

Of the 34 analysts covering Intel stock, only 6 rate it as either a “Strong Buy” or “Moderate Buy,” while 25 rate it as a “Hold” or some equivalent. The remaining 3 rate INTC as a “Strong Sell.”

The stock has a consensus rating of “Hold,” but its mean target price of $39.49 is 28.9% higher than current prices.

Will Intel Stock Go Back Up?

During the Q1 earnings call, CEO Pat Gelsinger, who the company brought back in early 2021, stressed that Q1 was the bottom for the company, and said Intel should report sequential revenue growth in the coming quarters this year, as well as in 2025.

He listed commercial PC refresh, demand for AI PCs, a recovery in the data center business, and “cyclical recoveries” in Mobileye (MBLY), Altera, and NEX as catalysts to drive growth in the coming quarters.

Gelsinger believes the losses in the foundry business will peak in 2024, and expects the segment to break even at the operating profit level “midway between now and the end of 2030” - which is roughly 2027.

The company aims to become the second-largest foundry globally by 2030, and expects the business to post operating margins of 30%. While those targets might sound ambitious, Intel is capitalizing on the onshoring of chip manufacturing - including in the U.S., where it is among the biggest beneficiaries of the CHIPS Act.

In its Products segment, Intel is working on advanced chips, including those with AI capabilities, to drive sales. Specifically, it has launched its Gaudi 3, which it says could “deliver on average 50% faster inference and 40% greater inference power efficiency than Nvidia H100 on leading generative AI (GenAI) models.” The company expects the business to post adjusted operating margins of 40% by 20230.

In its All Other segment, Intel is looking to unlock value. The company has already listed its Mobileye self-driving unit, and is looking at an IPO of Altera, as well.

Is Intel Stock a Buy Now?

Since Intel’s earnings are currently subdued, its valuation multiples appear elevated. For instance, the company’s next 12 months (NTM) price-to-earnings multiple is 24.2x, which is way above what the stock has historically traded at.

However, Intel’s earnings should rebound as the losses in its foundry business taper down and the business starts contributing positively to the bottom line, instead of being the drag that it is currently.

Intel faces several headwinds, and the company needs to execute on the ambitious 2030 targets that it has set. However, if the company can come even anywhere closer to the internal forecasts, it could become a multibagger by the end of this decade.

All of that said, while there will be short-term noise over Intel, I believe the business is on the right track under Gelsinger’s IDM 2.0 transformation plan. The stock might fit the bill for long-term investors who can be patient with the price action while enjoying the healthy dividend yield of 1.6% in the meantime.

On the date of publication, Mohit Oberoi had a position in: INTC , NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.