Financial giants have made a conspicuous bullish move on Sunrun. Our analysis of options history for Sunrun (NASDAQ:RUN) revealed 19 unusual trades.

Delving into the details, we found 68% of traders were bullish, while 21% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $725,700, and 13 were calls, valued at $484,428.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $20.0 for Sunrun over the last 3 months.

Volume & Open Interest Development

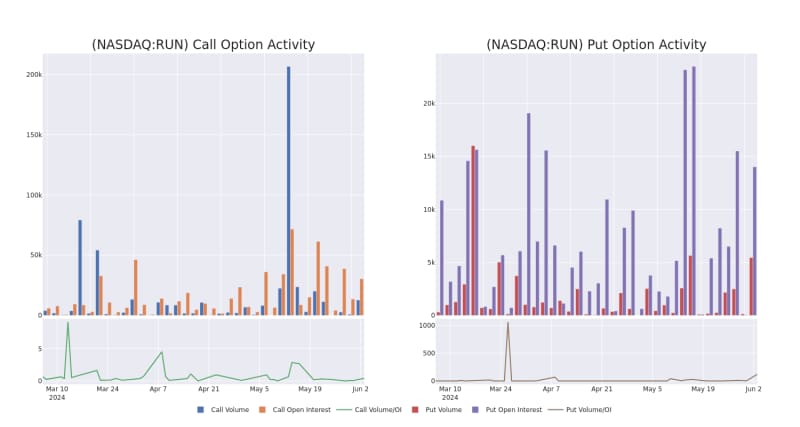

In today's trading context, the average open interest for options of Sunrun stands at 4943.78, with a total volume reaching 18,254.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Sunrun, situated within the strike price corridor from $10.0 to $20.0, throughout the last 30 days.

Sunrun Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

About Sunrun

Sunrun is engaged in the design, development, installation, sale, ownership, and maintenance of residential solar energy systems in the United States. The company acquires customers directly and through relationships with various solar and strategic partners. The solar systems are constructed either by Sunrun or by Sunrun's partners and are owned by the company. Sunrun's customers typically enter into 20- to 25-year agreements to utilize its solar energy system. The company also sells solar energy systems and products, such as panels and racking, and solar leads generated to customers.

After a thorough review of the options trading surrounding Sunrun, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Sunrun's Current Market Status

- With a volume of 7,209,507, the price of RUN is up 1.38% at $14.66.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 58 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Sunrun with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.